🪙 Gold Loan Calculator – Know How Much You Can Borrow Instantly

Gold isn’t just a beautiful metal — it’s also a powerful financial asset. In India, millions of people take gold loans to meet urgent needs like business cash flow, hospital bills, education fees, or home repairs. That’s where our Gold Loan Calculator helps you. It’s a free, easy-to-use tool that shows your eligible loan amount, EMI, and interest payable — in seconds.

👇 Try it now! 👇

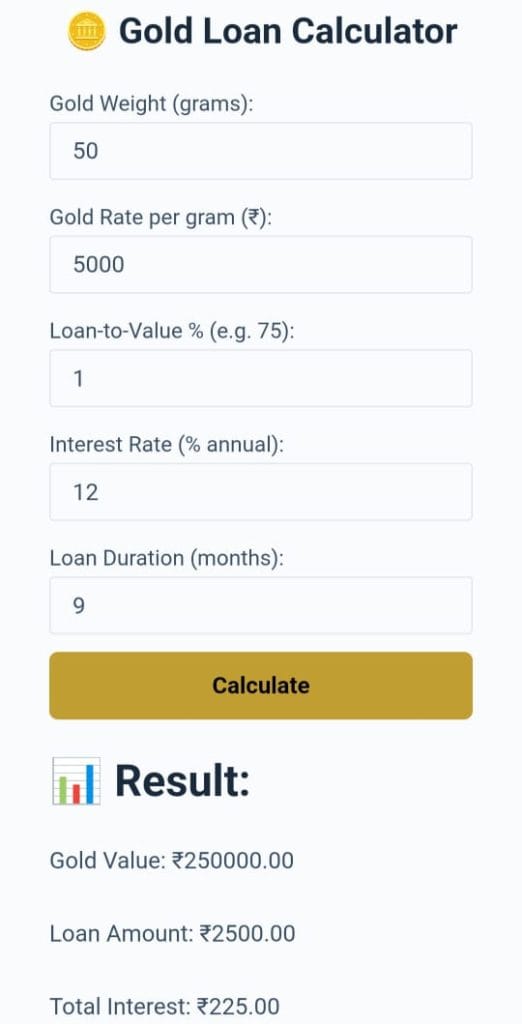

🪙 Gold Loan Calculator

📊Result Preview📊

🤔 What Is a Gold Loan?

A gold loan is a secured loan where you pledge your gold jewellery or coins with a bank or NBFC. Based on the weight and purity of gold, the lender gives you a loan — usually up to 75% of the gold’s market value.

It’s one of the fastest ways to borrow money — often approved within hours.

You can repay the loan through:

- Regular EMIs (like other loans)

- Interest-only payments

- Bullet repayment (entire amount at end)

But how do you know your eligibility and EMI before applying? Use this calculator.

🧠 What Does This Gold Loan Calculator Do?

It helps you figure out:

- ✅ How much loan you can get

- ✅ How much EMI you’ll pay every month

- ✅ Total interest and repayment amount

All you have to do is enter:

- 🔢 Gold weight (in grams)

- 🎯 Purity (in karats)

- 💰 Interest rate (annual)

- 🗓️ Loan tenure (months or years)

Click Calculate, and get instant answers. Try multiple combinations to plan smartly.

📊 Example Calculation

Let’s say:

- You have 50 grams of gold

- Purity is 22 karats

- Gold price = ₹5,800/gram (approx)

- Interest = 10%

- Tenure = 12 months

👉 You’ll get:

- Loan eligibility = ₹2,17,500 (75% of ₹2,90,000)

- EMI = ₹19,120

- Total repayment = ₹2,29,440

- Interest = ₹11,940

Now you know the real numbers before visiting a lender.

🏦 How Gold Loan Works (Quick Overview)

| Feature | Details |

|---|---|

| Loan type | Secured (backed by gold) |

| Max loan-to-value | Up to 75% of gold’s current value |

| Interest rates | 8.5% to 24% (varies by lender) |

| Tenure | 3 months to 3 years |

| Repayment modes | EMI, bullet, or overdraft |

| Lenders | Banks, NBFCs, gold loan companies |

| Processing time | Few hours to 1 day |

💡 Why Use This Calculator Before Applying?

| Benefit | Why It’s Useful |

|---|---|

| Know loan amount upfront | Helps you decide how much gold to pledge |

| Plan EMI easily | Avoids missing payments |

| Compare repayment plans | Choose bullet vs EMI vs overdraft wisely |

| See total interest | No hidden surprises |

| Use with any lender | Works for all banks and NBFCs |

🪙 What Affects Your Gold Loan Eligibility?

- Gold Purity – Higher karats = higher value

- Weight of Gold – More weight = more loan

- LTV Ratio (Loan-to-Value) – Usually max 75%

- Current Market Price – Gold rates vary daily

- Lender’s Policy – Some banks offer more or less

So, even with the same weight, your eligibility may differ by lender and market rate. Use this calculator with latest rates for best results.

📉 Tips to Get Maximum Loan

- Pledge only 22K or 24K purity gold (avoid 18K ornaments)

- Choose banks offering high LTV (like Muthoot, Manappuram, etc.)

- Track gold market price — apply when price is high

- Combine multiple ornaments to increase weight

- Keep bills or purity certificates, if available

❌ Mistakes to Avoid

| Mistake | Why It’s Costly |

|---|---|

| Not checking interest options | EMI vs bullet can be very different |

| Pledging low-purity gold | Reduces loan value |

| Ignoring repayment flexibility | May lead to default or penalties |

| Overborrowing | May lose gold if you can’t repay |

Using this calculator before pledging can save your gold and your peace of mind.

🔄 Types of Gold Loan Repayment Plans

- Regular EMI – Monthly EMI including interest + principal

- Interest-Only EMI – Pay only interest monthly; principal at end

- Bullet Repayment – Pay full interest + principal at end (no monthly EMIs)

- Overdraft Facility – Withdraw money as needed from a loan limit (like credit line)

This calculator is best suited for regular EMI planning.

💬 FAQs

Q: Can I use this for both banks and gold loan companies?

Yes! Just enter the applicable interest rate and tenure.

Q: What if my gold is not exactly 22K?

No problem. Select the nearest purity or enter custom value.

Q: Will using this calculator affect my credit score?

No. This is a tool only — no data is stored or reported.

Q: Can I change gold price manually?

Yes. You can enter current market price per gram in the calculator field.

✍️ Final Thoughts

A gold loan is one of the fastest ways to get money when you’re in a hurry — but only if you plan your repayment properly. Gold is precious, and nobody wants to lose it due to poor planning.

Using this Gold Loan Calculator helps you know exactly what you’ll get and what you’ll repay, so you stay in full control. Don’t leave it to chance — plan before you pledge.

Try the calculator now and stay worry-free. 💰✅🔐