🧮 What Is an Index Fund Calculator & Why You Should Use One Today

Ever wondered where your money is going when you invest in index funds? Or how much it can actually grow in the next few years? That’s where a smart tool like the Index Fund Calculator can really help. It might sound a bit technical, but trust me — it’s not just for finance geeks or number-crunchers. It’s for anyone who wants to understand their money better.

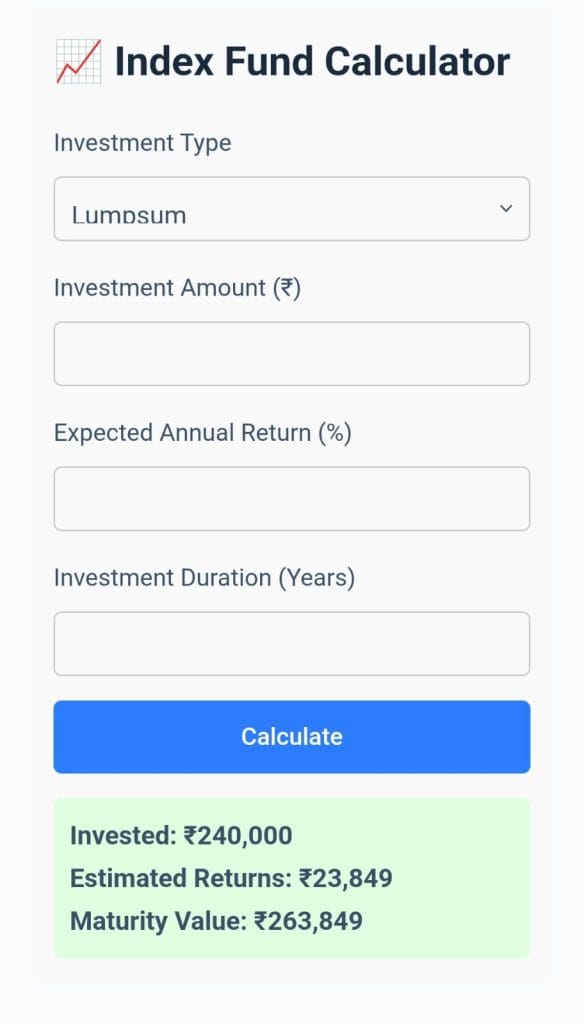

👇 Try it now! 👇

📈 Index Fund Calculator

📊Result Preview📊

🌱 Let’s Keep It Simple: What’s an Index Fund?

Before we dive into the calculator, let’s quickly break this down. An index fund is a type of mutual fund or ETF that tracks a specific financial market index — like the Nifty 50 or S&P 500. This means instead of picking individual stocks (which is risky and needs expert knowledge), you’re investing in an entire group of stocks that reflects the market’s performance.

Think of it like this: instead of betting on one horse, you’re betting on the entire race track.

So, naturally, this helps reduce risk while still offering good long-term growth. That’s why index funds are so popular — especially for beginners or people who don’t wanna actively manage investments.

🧠 Okay But… Why Do I Need a Calculator for That?

Well, here’s the deal. Investing is not just about putting in money and waiting. You need to know:

- How much will it grow in 5, 10, or 20 years?

- What if I invest monthly instead of one-time?

- How does my return change if the market grows at 8% vs 12%?

That’s where the Index Fund Calculator helps. It shows you:

- 💸 Your expected returns based on investment type (lump sum or SIP)

- 📊 Total interest earned

- 📅 Year-by-year breakdown

- 📈 The effect of compounding over time

Instead of guessing or using Excel formulas, this tool does the work for you in seconds.

🔍 How Does Zenvita’s Index Fund Calculator Work?

- Enter Initial Investment – how much you wanna start with

- Set Time Period – how many years you plan to invest

- Expected Rate of Return – usually between 8–15% depending on market

- Monthly Investment (Optional) – if you’re investing monthly via SIP

Click calculate, and BAM! You get a neat result showing:

- Final value of your investment

- How much profit you made

- Simple graph/chart of your returns

No math. No confusion. Just answers.

📈 Index Fund Returns: Real or Just Hype?

You might be wondering: “Do index funds actually give good returns?” Well, here’s a fact — most actively managed funds fail to beat the index in the long run. The S&P 500 has delivered around 10% average annual returns for the last few decades.

So yeah, index funds are not hype. They’re smart, steady, and historically reliable.

Let’s do a quick example using a tool:

Example

You invest ₹5,000 per month for 10 years into an index fund with an average return of 12%.

👉 Using the Zenvita Index Fund Calculator, you’d get:

- Total Invested: ₹6,00,000

- Final Value: ₹11,61,695

- Profit: ₹5,61,695

That’s the power of compounding. You invest slowly, and money multiplies quietly in the background.

🧮 Difference Between Index Fund Calculator and SIP Calculator

Now you might say: “Wait, isn’t that just like the SIP Calculator?”

Well, kinda… but not exactly.

- The SIP Calculator only focuses on monthly investments.

- The Index Fund Calculator lets you do:

- Lump sum investing

- Monthly SIP

- One-time + recurring combo

- More accurate market-index based predictions

Also, it can help compare different market index returns. For example:

- Nifty 50 Index: 10–12% annually

- Nifty Next 50: sometimes higher risk, higher return

- S&P 500 (US): ~10% annually

So it’s more tailored for long-term index investing.

🛠️ How to Use Zenvita’s Index Fund Calculator Like a Pro

Here’s some simple tips:

- Don’t overestimate your expected return. 12% is decent. 15% is too optimistic.

- Try different timeframes — see how 10 years vs 20 years makes a huge difference.

- Use monthly SIP and compare with one-time investments

- Share results with friends or save the charts (some tools like ours allow exporting)

A good calculator will help you plan smarter — whether you’re investing for retirement, a house, or your child’s education.

🔐 Is It Safe To Use Online Investment Calculators?

Good question.

Yes, as long as you’re not entering private details like PAN, Aadhar, or bank info. Our Index Fund Calculator just takes numbers — and we don’t save or share any of your data.

So it’s completely anonymous and safe.

💬 Final Thoughts

If you’re someone who wants to take control of your finances, or just want to see “how much can I make with ₹10,000 a month”, this calculator is for you.

You don’t need to be a financial expert to use it. You just need to be curious.

Try the Index Fund Calculator today and see your money’s future in 10 seconds or less.

Because it’s not about how much you earn — it’s about how smartly you invest 💸