📈 Understanding ETFs & How an ETF Calculator Can Make Life Easier

Exchange-Traded Funds (or ETFs) are becoming super popular nowadays. Lot of people, especially new investors, are going for them instead of picking individual stocks or mutual funds. But the thing is… not everyone knows how to calculate ETF returns or estimate the future value of their investment. That’s where tools like an ETF Calculator come in.

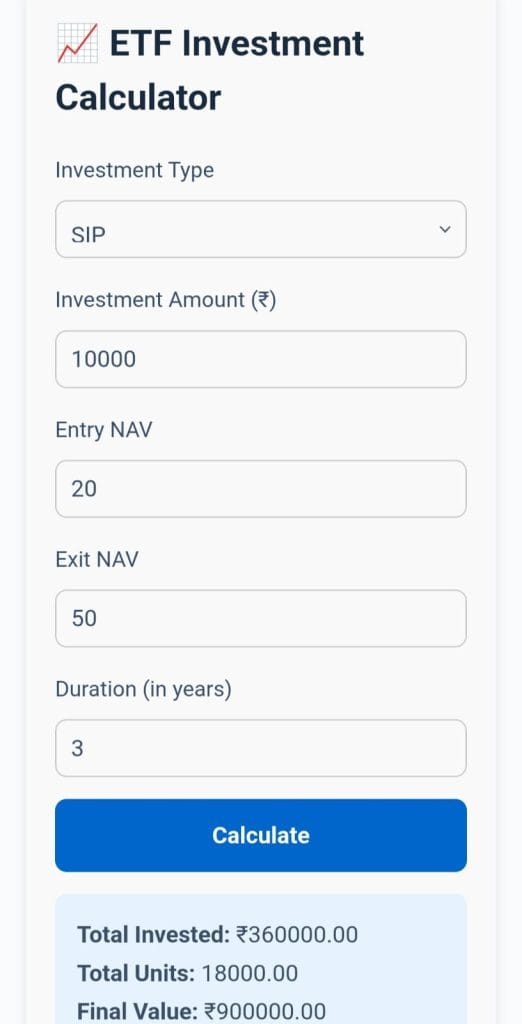

👇 Try it now! 👇

📈 ETF Investment Calculator

📊Result Preview📊

🤔 What is an ETF?

So, ETF stands for Exchange-Traded Fund. Basically, it’s a basket of securities — like stocks, bonds, or commodities — that you can buy and sell on a stock exchange, just like regular shares.

Let’s say you want to invest in tech companies, but don’t wanna pick just one. An ETF can give you exposure to all of them (Apple, Microsoft, Google, etc.) in one go.

Few key points:

- It’s diversified (less risk)

- It trades like a stock

- You can buy/sell anytime during market hours

- Often comes with lower fees than mutual funds

💰 Why People Love ETFs?

Well, there’s a reason ETFs are trending. A few benefits:

- Low cost: Most ETFs have super low expense ratios

- Easy access: You can buy them from any stock broker platform

- Tax-efficient: Unlike mutual funds, ETFs don’t usually create big tax events

- Transparency: You know what you’re buying. Most ETFs publish their holdings daily.

But still, many folks are confused when it comes to calculating ETF returns. That’s exactly where an ETF Calculator helps you.

📊 What is an ETF Calculator?

An ETF Calculator is an online tool that helps you estimate your returns based on:

- The amount you invested

- The annual return rate (average performance of the ETF)

- The duration (how long you keep it)

- Whether you invest one time or regularly (like SIP)

Think of it like a helper who does all the boring math for you 😅

For example, if you invest ₹10,000 per month in an ETF with a 12% annual return for 5 years, it tells you how much you’ll have at the end — both principal and total gains.

You don’t need Excel formulas or financial knowledge to use it.

🛠️ How Does It Work Behind the Scenes?

Even though it looks simple on the front end, there’s some interesting calculation going on.

The calculator usually uses something like this formula:

Future Value (FV) = P × [(1 + r)^n – 1] / r

Where:

- P = monthly investment (if it’s a SIP-style investment)

- r = monthly return rate (like 12% / 12 months = 1%)

- n = number of months

If you invested one-time (lump sum), then it’s even simpler:

FV = P × (1 + r)^n

But honestly, you don’t need to worry about all this. That’s what the calculator is for. Just enter your values and boom — you get a neat result.

📈 Real-Life Example

Let’s say Priya, a 25-year-old, invests ₹5,000/month in a Nifty 50 ETF that returns 11% annually.

She does this for 10 years.

Using an ETF Calculator, here’s what she sees:

- Total invested: ₹6,00,000

- Future Value: ₹10,39,000+

- Total profit: ₹4.3+ lakhs

She didn’t need to open Excel or talk to any advisor. Just used a free tool online.

🧠 Why Use a Calculator Instead of Guessing?

People often think they can guess how much they’ll make. But the human brain isn’t great at compounding math.

These are the reasons to actually use an ETF Calculator:

- ✅ Visualize the future — see your goal clearly

- ✅ Compare ETFs — check which one gives better result

- ✅ Plan your monthly investments smartly

- ✅ Avoid surprises — Know how long it takes to reach your target

📌 Pro Tips for Using ETF Calculator

- Be realistic about returns – Don’t assume 18% return every year. Most ETFs in India give 10–14% depending on the market.

- Use it for SIPs too – Many ETF investors do monthly SIPs. Good calculators support both lump sum and SIP modes.

- Check different durations – Try 5 years, 10 years, 15 years. Longer duration always grows more due to compounding.

- Try multiple ETFs – Like Nifty 50 vs Nifty Next 50 vs sector ETFs (e.g. Banking or IT).

🧠 Final Thoughts on ETF Calculator

ETFs are one of the smartest, easiest, and low-cost ways to invest today. Whether you’re a college student or someone working in a job, ETFs make wealth-building simple.

But don’t just blindly invest. Use an ETF Calculator to actually see your journey before you start.

You’ll be surprised how small consistent investments can grow big in just a few years. And the best part? You don’t need to be a finance genius to do this — just a calculator and a little time.