Why You Need an Investment Calculator Before You Even Think of Investing

Investing is not just for rich people anymore. It’s something we all should be doing, whether you’re a college student saving your stipend or a working professional planning for future. But here’s the truth—most people don’t know where to start. Some just throw money into crypto, some follow random YouTube advices, and others just leave it in savings account thinking it’s enough. Spoiler: it’s not. Before you do anything with your money, there’s one tool you absolutely need. An Investment Calculator.

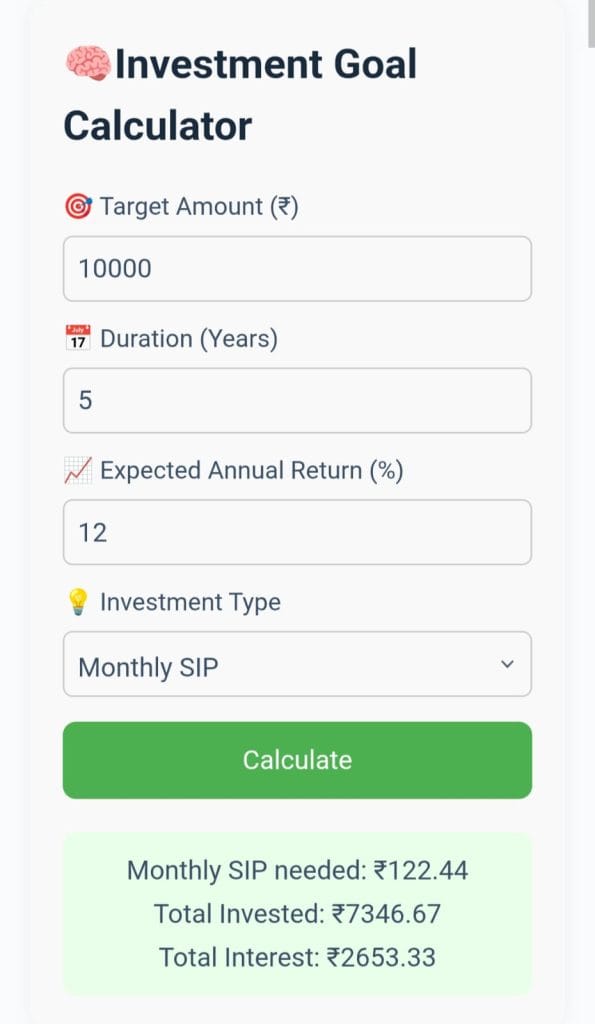

👇 Try it now! 👇

🧠Investment Goal Calculator

📊Result Preview📊

Now, you might think, “I don’t need it, I’m not investing big amounts.” But that’s exactly why you need it. Even small investments can turn big with time—if you calculate it right.

💡 What is an Investment Calculator?

Okay, think of an investment calculator like a crystal ball. Not the magical type, but the logical one. It tells you:

- How much your money will grow

- What you can expect after x years

- How monthly contributions change your returns

- How interest works for you (instead of against)

An investment calculator just takes your input (amount, rate of return, time), does some number magic (math formulas, not sorcery lol), and shows you the future value.

And the best part? You can try different situations to see what works. Like:

- “What if I invest ₹2000 per month for 5 years at 12%?”

- “How much will ₹50,000 become if I keep it for 10 years?”

- “If I want ₹5 lakh in 3 years, how much should I invest monthly?”

Instead of guessing, you know.

🧠 Why Most People Don’t Use It (And Why You Should)

Honestly, calculators sound boring. No one wakes up and goes, “Today I’ll do some investment math!”

But ignoring it is why many end up disappointed. You’ll hear people say:

“I invested in XYZ for 3 years and only got 10% return, bro!”

Yeah, because they didn’t check how compound interest works. Or how inflation affects value. Or that SIP returns take time to grow. A good Investment Calculator solves all these.

You don’t need to be a CA or finance expert. You just need a tool that does the math for you.

🧮 How to Use Our Investment Calculator

We made it simple on purpose. No complicated screens or login needed.

Here’s how it works:

- Enter the initial amount – like ₹10,000

- Choose monthly investment – like ₹2,000 per month

- Set interest rate – 10% is average for mutual funds

- Select time duration – like 5 years

- Boom! Your future amount appears ✨

You’ll see your total invested, interest earned, and final value.

Want to try again with higher amount? Just change the numbers. You can even use it to compare:

- SIP vs. Lump sum

- Short term vs. Long term

- High risk vs. Low risk plans

💰 Why Calculating Investments Matter

Let’s be real—everyone wants to be rich, right? But wealth doesn’t come just from saving. It comes from knowing how to grow your money.

Here’s what happens when you don’t calculate before investing:

- You invest too little and fall short of your goals

- You invest too late and regret not starting early

- You get excited about returns but ignore risk

- You have no idea what you’ll actually get

Using an investment calculator makes things real. It makes you think: “Wow, if I just start with ₹1500/month now, I can have ₹10 lakh in 10 years!”

And that motivates you to keep going.

📊 Real Examples Using the Calculator

Let’s do a few quick examples that real people might try:

1. The Beginner Investor (₹1000/month for 5 years)

- Principal: ₹60,000

- Rate: 10%

- Final Value: ₹77,556

- Interest Earned: ₹17,556

That’s over 29% gain—without doing anything!

2. The Aggressive Planner (₹5000/month for 10 years)

- Principal: ₹6,00,000

- Rate: 12%

- Final Value: ₹11,61,695

- Interest Earned: ₹5,61,695

That’s compound power 🔥

Want to see your own numbers? ➡️ Use Investment Calculator

📢 Don’t Be Late. Start Now.

Most people keep delaying investments thinking they’ll “start later.” Problem is—later never comes.

Even if it’s just ₹500 per month, start now. The earlier you begin, the lesser you need to invest over time.

Use the Investment Calculator to build your plan today. See how little it takes to reach your goals.

No guessing. No fear. Just numbers.

🤔 Final Thoughts on investment calculator

Money isn’t everything. But not having enough money when you need it—it’s stressful.

So invest smart. Don’t do guesswork. Use tools. Use logic. And make every rupee count.

Zenvita Tools exists to make that easy for you.

➡️ Use our Investment Calculator now