📈 How an Investment Growth Calculator Can Make You a Smarter Investor

Investing money is not just for rich people anymore. These days, anyone with a smartphone and some savings can start growing their wealth. But the thing is, a lot of people don’t really understand how fast their investments can actually grow. That’s where tools like an Investment Growth Calculator comes in handy.

You might be thinking—why do I even need one? I already know how much I’m investing. But here’s the thing… most of us don’t fully understand how compound interest works, or how much a small change in monthly savings can affect future returns. That’s where this calculator becomes a real eye-opener.

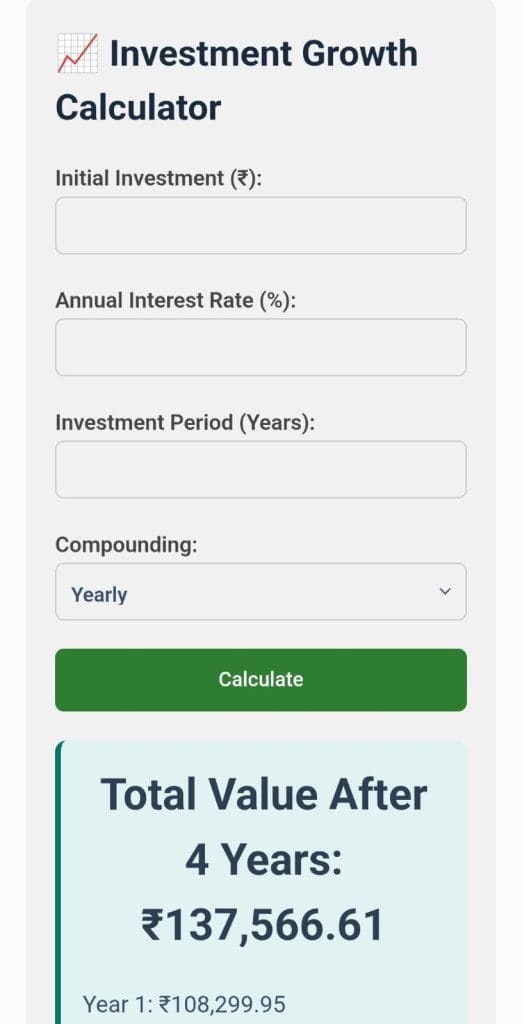

👇 Try it now! 👇

📈 Investment Growth Calculator

📊Result Preview📊

Let’s talk about it in detail. And don’t worry—I’ll keep things simple. No complicated finance jargon here.

🌱 What Is an Investment Growth Calculator?

An Investment Growth Tool is a free online tool that helps you estimate how your money will grow over time. It takes things like:

- Your initial investment

- Monthly contribution

- Expected rate of return

- Investment time period

…and tells you how much your total investment could be worth in the future.

So basically, instead of guessing how much your money might grow, you can actually see the numbers based on real math.

🤯 Why Most People Underestimate Their Investment Growth

Believe it or not, most people don’t realise how powerful compound growth is. Let me give you an example:

Let’s say you invest just ₹5,000 per month at 12% interest rate for 15 years.

You might think you’ll end up with 5,000 x 12 x 15 = ₹9,00,000 right?

Wrong.

With compound interest, that grows to nearly ₹25 lakhs+. That’s almost 3x the amount you invest.

If you had an Investment Growth Calculator, you’d see that clearly. It’s like magic — but real and math-backed.

💡 How to Use an Investment Growth Calculator (The Easy Way)

Most calculators are super easy to use. Ours at Zenvita Tools is made specially for mobile and beginners. You just enter:

- Initial investment (₹0 is also fine)

- Monthly contribution (like ₹3000 or ₹5000)

- Expected return rate (usually between 10%–15% for mutual funds or index funds)

- Time period (in years — 5, 10, 15, or even 30!)

Then hit calculate, and boom — you’ll see how much your investment will grow over time, total interest earned, and the full chart.

👀 Real Life Scenarios: How Small Changes Impact Results

Let’s say you’re 25 now, and want to start saving ₹2,000/month for 20 years.

- If you start today, your wealth might grow to ₹14–15 lakhs

- If you delay by just 5 years, you’ll lose lakhs in return

This is why we made the Investment Growth Calculator super simple — to help you visualize the cost of delay.

🧠 Tips to Make the Most of This Calculator

Here’s a few things you should try when using it:

- ✅ Try different interest rates (8%, 10%, 12%, 15%) to compare low-risk vs. high-risk options

- ✅ Add small amounts like ₹500 extra per month and see how much it adds up

- ✅ Use it to compare long-term goals: marriage, retirement, kids’ education, etc.

Also, if you’re doing SIP or mutual funds, this calculator works perfectly for those cases too.

🔁 Monthly vs Lump Sum: Which One Grows More?

You can use the calculator to see which method gives better returns:

- If you invest ₹1 lakh as lump sum

- Or ₹5,000 every month

Which one wins?

Well, both has benefits, but monthly investing builds habit. And surprisingly, it can sometimes beat lump sum if market averages out well. Try both options and compare them.

📱 Built for Everyday Users (Not Finance Experts)

Unlike those complicated Excel sheets or bank tools, our Investment Growth Calculator is:

- 📱 Mobile-friendly (works smooth on phone)

- 🎯 Super fast

- 🆓 Free to use

- 🔐 Doesn’t collect your data

Whether you’re a student, employee, or freelancer, you can use it daily, monthly or even for planning your entire future.

🤔 Why Use a Calculator at All?

Here’s the deal:

- You can’t make financial decisions on guesswork

- Knowing how your money grows helps you invest smarter

- You get confidence to set bigger goals

Think of it like Google Maps — would you travel to an unknown place without directions? Same way, you shouldn’t invest without knowing your growth path.

That’s what the calculator gives you — a map of your future money.

⚖️ Investment Planning vs Reality

Let’s face it — we all plan to save more. But when salary comes, Netflix subscription, Zomato, new t-shirts… and poof 💸

That’s why calculators like this give you clarity and motivation.

When you actually see how just ₹1000 more can give you ₹4–5 lakh extra in 20 years, it pushes you to save better.

These all are part of our free 📈 Investment & SIP Tools section — explore them to take better decisions.

📌 Final Thoughts

An Investment Growth Calculator might look like a small tool, but it has a big impact. Whether you’re saving for your dream house, a world trip, or just building emergency funds — seeing the numbers makes everything easier.

It’s not just about money. It’s about control, planning, and peace of mind.

So stop guessing, and start growing. Try our calculator now — and see what your money can become in 5, 10, or 25 years.