📊 Share Return Calculator – Know Your Stock Profits Easily!

Are you someone who invests in the stock market or planning to start soon? If yes, then knowing how much return you are getting from your shares is super important. But let’s be honest, calculating it manually every time is a bit of a headache. That’s where our Share Return Calculator comes in handy.

In this blog, let’s talk about how the calculator works, why it’s useful, and some real-life examples to help you understand better. Also, don’t worry… this won’t be boring.

👇 Try it now! 👇

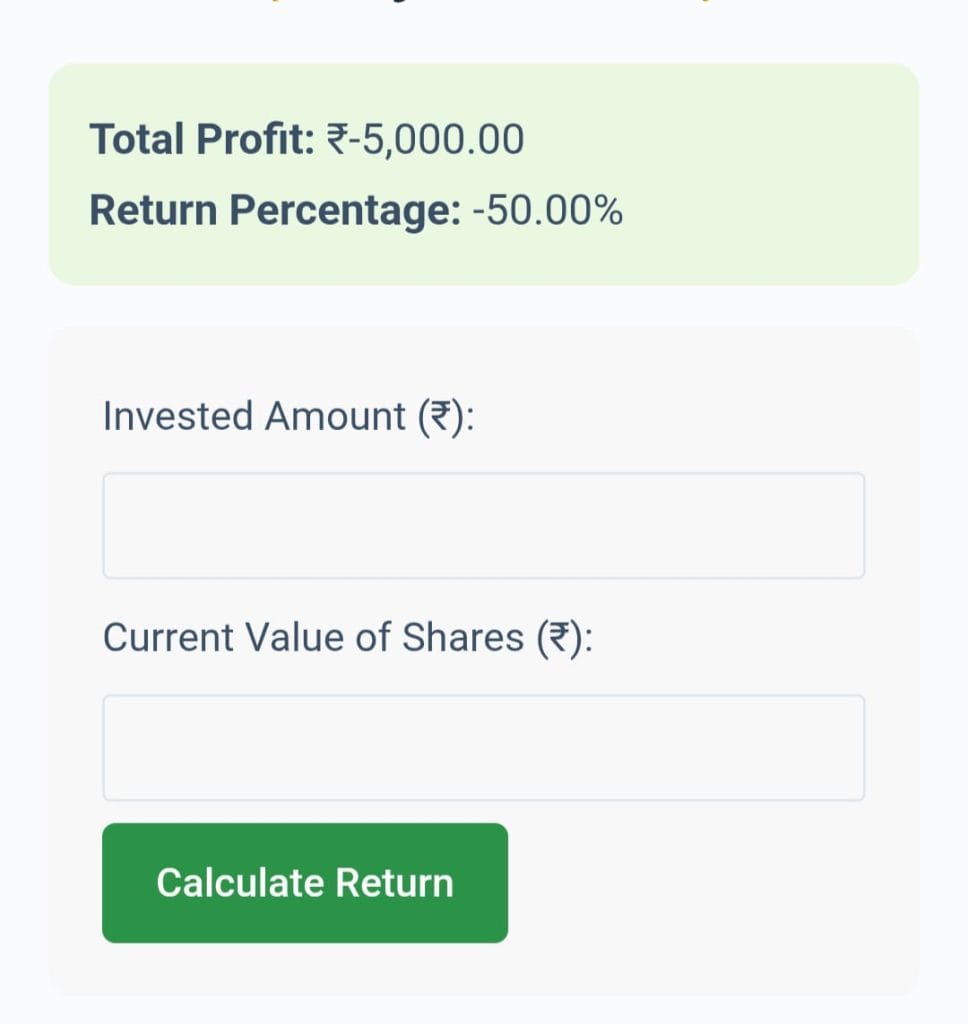

📊Result Preview📊

🧐 What is a Share Return Calculator?

A Share Return Calculator is a simple online tool that helps you calculate the total return you earned from a stock investment. You just enter the buy price, sell price, number of shares, and boom! It shows you the profit or loss.

But wait, it’s not just about profit… it also helps in understanding:

- % Return

- Absolute profit/loss

- Investment value growth 📈

And guess what? You don’t need to be a math expert to use it. Even your grandma can check her Tata Motors return.

💡 Why Use a Share Return Calculator?

Let’s be real — not everyone likes doing manual calculations. And in investing, accuracy matters a lot. Here’s why this tool is super useful:

1. Quick Results

You get instant calculations without any error. Just enter a few numbers.

2. Helps You Plan Better

Let’s say you bought a share at ₹500 and sold it at ₹700. The calculator tells you the exact return, so you know how good your investment decision was.

3. No Excel Sheets

Gone are the days when people used to open spreadsheets and struggle with formulas. This tool makes life easy.

4. Track Multiple Investments

If you’re someone who buys/sells frequently, this is perfect. You can check return for each trade quickly.

🧮 How Does Share Return Calculator Work?

It’s simple. You just need to enter these 3-4 things:

- Buy Price – the price at which you bought the stock.

- Sell Price – price at which you sold (or current price if you still holding).

- No. of Shares – how many shares you bought.

- Brokerage (optional) – if you want to include charges too.

Once you fill that, the calculator shows:

✅ Total Investment

✅ Selling Amount

✅ Profit or Loss

✅ Percentage Return

📈 Real-Life Example

Let’s take an example.

You bought 100 shares of Infosys at ₹1500 each. After 1 year, you sold them at ₹1800.

Let’s put this in the calculator:

- Buy Price = ₹1500

- Sell Price = ₹1800

- Shares = 100

Result:

- Investment = ₹1,50,000

- Return = ₹1,80,000

- Profit = ₹30,000

- Return = 20%

Nice, right? 😊

Now imagine if you made multiple trades like this. Tracking all without a calculator will be messy.

🧠 Common Mistakes People Make

While using a Share Return Calculator is easy, some people make silly mistakes. Here are a few:

❌ Forgetting to include brokerage

This may seem small but it affects total return, especially for large trades.

❌ Using average price wrong

If you bought shares in different lots, always calculate average buy price.

❌ Entering wrong number of shares

Always double-check how many shares you actually bought or sold.

📌 Where You Can Use Share Return Calculator?

This tool is not just for day traders. It’s helpful for:

- Long-term investors – to see how much their investments grew 📊

- Beginners – who are learning stock market

- Finance bloggers – to show example returns

- Portfolio tracking – to compare which share gave better returns

Even if you’re using apps like Zerodha or Groww, they don’t always show exact % gain after all charges. Our calculator makes it easy.

🔧 Behind the Math (for nerds 😁)

The formula is pretty simple:

Return = (Sell Price – Buy Price) x Number of Shares

Return % = ((Sell – Buy) ÷ Buy) × 100

If brokerage or tax is included, just subtract that from the profit. Done!

But don’t worry — you don’t have to do this manually. The tool does it all behind the scenes.

🤑 How it Helps in Better Investing?

Knowing your return helps you make smart decisions. For example:

- You can compare stocks easily

- You can check if long-term investment worked better than short-term

- You can improve your portfolio based on past returns

A lot of times people feel like they made good profit, but after checking the calculator — it’s less than expected. This helps avoid illusions.

🙋♂️ Frequently Asked Questions

Q. Can I use it for ongoing investments?

Yes! Just enter the current share price as “Sell Price”.

Q. What if I bought in different lots?

Calculate the average buy price and then enter that.

Q. Is this calculator free?

100% free! 🎉 Use as many times as you want.

Q. Does it work on mobile?

Absolutely. The calculator is mobile friendly 📱 and works fast.

🔚 Final Words on Share Return Calculator

Using a Share Return Calculator might seem like a small thing, but it can save you from big investing mistakes. It’s quick, accurate, and doesn’t need a login or any technical skill.

Next time before showing off your stock profit to friends 😎, check your return with this tool first.