Why You Should Use a SIP Plan Calculator Before Investing

Have you ever wondered how much money you’ll have after investing monthly into a mutual fund for years? Or maybe you’re unsure about how much you need to invest every month to reach a future goal? That’s where a SIP Plan Calculator becomes super useful.

Most of us, when we hear about investing, feel either confused or overwhelmed. And honestly, the financial words and all that calculation stuff can make things worse. But don’t worry – in this post, I’m going to break down what a SIP plan calculator is, how it works, and why you should use it – especially if you want to save smart and grow your money.

👇 Try it now! 👇

📈 SIP Plan Calculator

📊Result Preview📊

📌 What is SIP Anyway?

SIP stands for Systematic Investment Plan. It’s one of the easiest ways to invest in mutual funds. With SIP, you invest a fixed amount every month or quarter, instead of putting a big lump sum at once.

Think of it like your Netflix subscription, but instead of entertainment, you’re buying mutual fund units monthly. Slowly and steadily, it builds up. That’s the beauty of SIP.

🤖 What is a SIP Plan Calculator?

Now, doing calculations in your mind or using a pen-paper might be not just boring, but also confusing. Like:

- How much returns will I get after 10 years?

- What if I increase my SIP amount?

- How will market returns affect my final value?

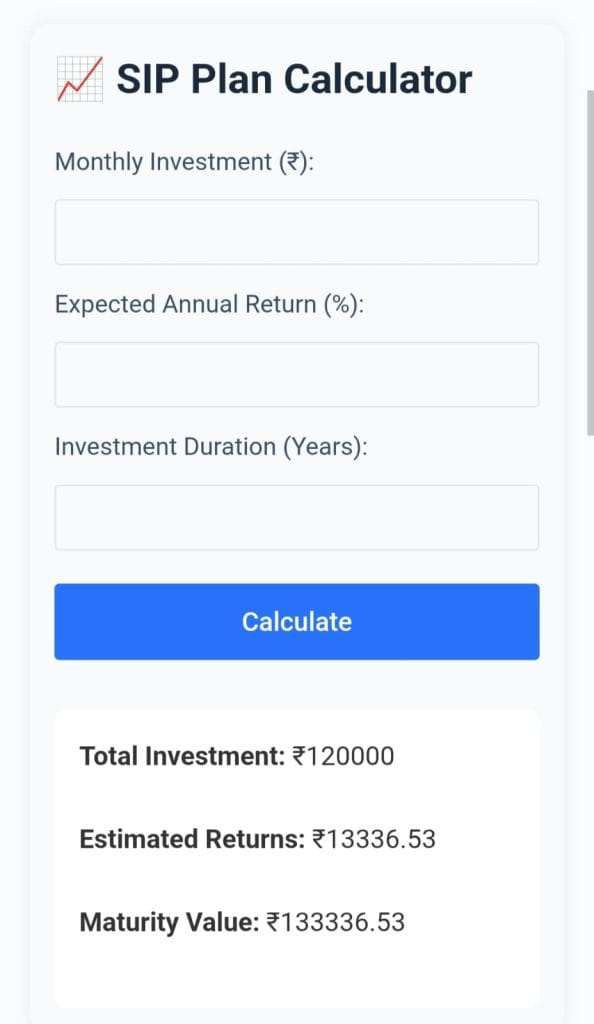

A SIP Plan Calculator helps to answer all these questions instantly. You just need to enter:

- Monthly Investment – how much you’re putting every month

- Duration – for how long you’ll invest (e.g., 5, 10, 20 years)

- Expected Annual Return – usually between 10%–15% for equity mutual funds

Once you hit calculate, it shows the total invested amount, estimated returns, and future value.

🎯 Example of Using SIP Calculator

Let’s take a small example. Suppose you invest ₹2,000 every month for 10 years, and you expect 12% annual returns.

The SIP Plan Calculator will show:

- Invested Amount = ₹2,40,000

- Estimated Returns = ₹1,76,000 (approx.)

- Total Value = ₹4,16,000

That’s almost double your money in 10 years just by doing small investments consistently.

😬 Why Manual Calculation is a Bad Idea?

Let’s be honest. Doing SIP math manually is a headache. You need to apply complex formulas like:

FV = P × [ (1 + r)^n – 1 ] × (1 + r) / rWho has time to solve that? Even Excel formulas can confuse non-finance people.

A SIP calculator saves you time, effort, and avoids mistakes. It makes planning easier for everyone, even students or first-time investors.

✅ Benefits of SIP Plan Calculator

- Easy to Use – Even your dad can use it without tutorials.

- Saves Time – No pen, no Excel sheet, just input & go.

- Free of Cost – Most calculators (like the one on Zenvita Tools) are completely free.

- Visual Insights – Many calculators show pie charts or graphs to understand growth.

- Better Goal Planning – You can check how much to invest monthly to reach a specific goal.

🧠 Tips for Using SIP Calculator Smartly

- Don’t over-expect returns – Use average returns (10%–12%) instead of dreaming 20%.

- Try different scenarios – Change the investment amount and duration to see different results.

- Include inflation – Your future money might buy less, so plan more than you need.

- Use it regularly – Check your goals every 6 months and adjust SIP if needed.

🏠 SIP Calculator for Different Goals

You can use SIP planning for multiple life goals. For example:

- Buying a house – Estimate how much monthly SIP is needed in 10–15 years.

- Child’s education – Plan how much education will cost in 2040 and invest accordingly.

- Retirement – Start early and let SIP build a huge corpus over 25–30 years.

The earlier you start, the better the compounding.

🧮 SIP vs Lumpsum: Why SIP is Safer for Beginners?

Many people ask – why not just invest ₹1 lakh at once?

Well, SIP is safer. It reduces market risk through rupee cost averaging. That means, when the market is low, you buy more units, and when high, you buy less. In long term, it smooths out the price.

Also, not everyone has ₹1 lakh ready. SIP helps you start small and stay consistent.

🔧 How to Access a SIP Plan Calculator?

There are many SIP calculators online, but some are slow or confusing. On Zenvita Tools, the SIP Plan Calculator is fast, mobile-friendly and shows result instantly. No ads, no login.

To use it:

- Visit the SIP Plan Calculator tool on Zenvita.

- Enter your monthly SIP amount

- Enter the number of years

- Add your expected annual return

- Hit Calculate

Done. You’ll get everything you need.

😍 Why I Love SIP (and You Should Too)

I started SIPs during my first job. ₹500 a month. Didn’t feel like much. But 5 years later, I saw how nicely it grew. Now, I invest more every year.

The best thing about SIPs is that they build discipline. You don’t feel the pinch of money going out, but after years, you feel proud when you see your fund growing like a tree.

And having a SIP calculator helps to visualize that growth. It keeps you motivated to continue.

🚀 Final Thoughts

If you’re someone who wants to invest but always thinks:

“I don’t understand the numbers”

“What if I don’t get good returns?”

“How much should I invest monthly?”

Then stop guessing.

Use a SIP Plan Calculator to plan clearly. It’s free, fast, and gives you confidence in your investing journey.

Even if you’re earning average, SIPs can make your future bright — just be consistent.

And next time when someone says “you need lakhs to invest”, tell them, “No, I just started with ₹500.”