SIP Return Calculator: Know How Much You Can Earn! 📈💰

Investing can feel a bit scary when you’re just getting started, right? 😅 There’s so many terms—mutual funds, SIPs, returns, risks, and so on. But hey, don’t worry, one thing that makes life simple is a SIP Return Calculator. This small online tool can help you figure out how much your investment might grow over time. Sounds cool? Yeah, it really is!

In this blog, I’ll explain everything about SIP return calculators, why they matter, how they work, and how you can use them wisely. It’s not going to be boring, I promise 😄

👇 Try it now! 👇

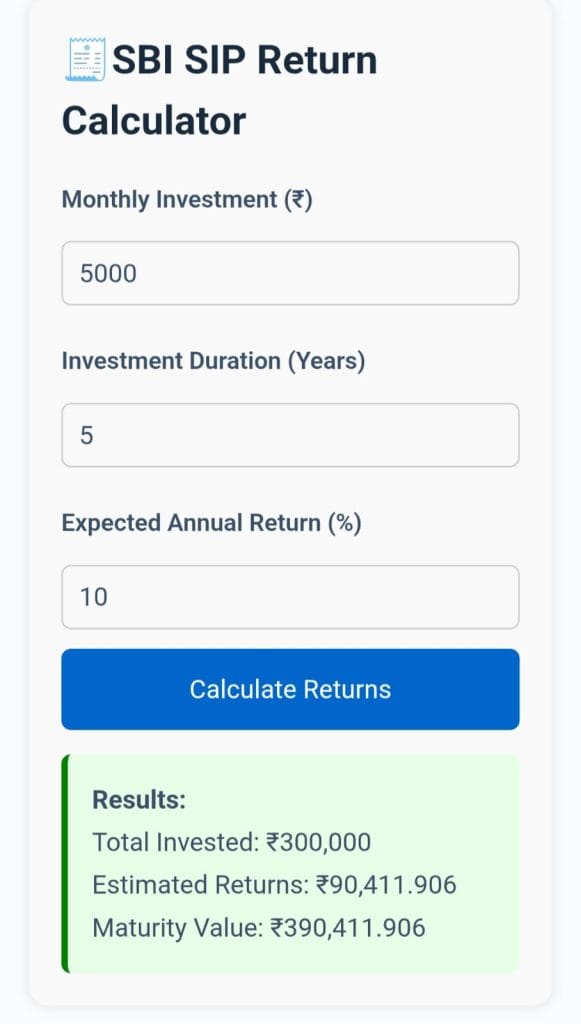

🧾SBI SIP Return Calculator

📊Result Preview📊

🧠 What is SIP?

First of all, let’s understand what SIP means. SIP stands for Systematic Investment Plan. It’s a way to invest in mutual funds where you put in a fixed amount every month, like ₹500 or ₹2000 or any amount you’re comfortable with.

Instead of putting ₹1 lakh all at once, you break it into parts and invest monthly. It helps you manage your budget and also reduce risks over time. That’s because markets go up and down, and SIPs allow you to benefit from these ups and downs with rupee cost averaging.

📊 What is a SIP Return Calculator?

The SIP Return Calculator is an online tool that helps you estimate how much returns you can earn from your SIP investments over time. You just enter some simple details like:

- Investment Amount (monthly)

- Investment Duration (in years)

- Expected Annual Return (in %)

And boom 💥 the calculator shows you:

- Total Invested Amount

- Estimated Returns

- Final Value (Invested + Returns)

It saves your time and removes guess work. Plus, it’s free! 😉

🧐 Why Use a SIP Return Calculator?

You might be wondering, “Can’t I just guess the returns myself?” Well… you can, but let me explain why a calculator is better.

- Saves Time & Effort: Doing manual calculations can be confusing and take time. The calculator gives results in seconds.

- Better Planning: You can plan your goals better. Want to save ₹10 lakhs in 5 years? Just enter the values and see how much you need to invest monthly.

- Motivation Boost: When you see how small investments grow big over years, you feel encouraged to keep investing 🥳

- Try Different Scenarios: You can test what happens if you increase your SIP amount or duration or returns.

🧮 How Does the Calculator Work?

The SIP return calculator uses a simple formula based on the compound interest logic. The actual formula is:

FV = P × [ (1 + r)^n - 1 ] × (1 + r) / r

Where:

- FV = Future Value (Total expected returns)

- P = SIP amount

- r = Rate of return per month (Annual rate ÷ 12 ÷ 100)

- n = Number of months

Don’t worry if that looked complicated 🫠 — the calculator does all this behind the scenes for you.

💡 Example of SIP Calculation

Let’s say you want to invest ₹3000 every month for 10 years. You expect around 12% annual return from mutual funds.

Using the SIP Return Calculator:

- Monthly SIP: ₹3000

- Tenure: 10 years (120 months)

- Expected Return: 12%

🔍 The calculator might show:

- Total Invested = ₹3.6 lakhs

- Estimated Returns = ₹4.8 lakhs

- Final Value = ₹8.4 lakhs 🥳

That’s more than double! Thanks to compounding power.

🏆 Benefits of Using SIPs + Calculator

- ✅ Discipline: SIP makes you invest regularly

- ✅ Affordability: Start with ₹100 or ₹500

- ✅ Power of Compounding: Big gains in long term

- ✅ Flexible Goals: For kids, house, vacation, anything!

- ✅ User Friendly Tools: You don’t need to be a finance expert

Just imagine, even if you forget finance formulas or investment rules, this calculator has your back 💪

🤔 Are SIP Returns Guaranteed?

Quick answer: No.

SIP invests in mutual funds, and mutual funds invest in stocks, bonds, etc. So, returns depend on the market. But over long term, equity SIPs have shown good average returns—usually between 10% to 15%. Still, there is always some risk.

So it’s better to stay invested longer (like 5+ years) to reduce risks and get good growth.

🚫 Common Mistakes to Avoid

Even though calculators are easy, many people still make some common errors. Let me help you avoid them:

- ❌ Expecting exact returns – The calculator shows estimated returns, not fixed. Market returns can vary.

- ❌ Short-term investing – SIPs work best when you stay invested for long.

- ❌ Changing SIP frequently – Don’t panic when the market goes down. Stick to your plan.

- ❌ Ignoring inflation – Always check if your final amount will beat inflation.

🧭 Pro Tips for Beginners

- Start early – More years = More growth!

- Increase SIP with your income rise (use Step-up SIP if available)

- Track your goals yearly using the calculator

- Rebalance your mutual funds every year (if needed)

🛠️ Where to Use SIP Return Calculator?

There are many websites offering this tool. One such place is Zenvita Tools, where SIP calculators are mobile-friendly, fast and completely free to use.

No signups, no fees, just clean and quick results! You can try different tools for other investment types too.

🔚 Final Words on SIP Return Calculator

SIP is like a financial best friend for beginners 👫 — you don’t need to time the market or know deep finance. Just invest a small amount every month, stay patient, and use the SIP Return Calculator to track your progress.

Remember, every big wealth starts with small steps. 💡

So don’t wait. Start your SIP today and see the magic of compounding tomorrow! ✨