🚘 Auto EMI Calculator – Plan Your Vehicle Loan with Ease

Thinking of buying a new car or a bike? That’s exciting! 🚙💨 But wait — how much EMI will you need to pay every month? Will it fit your monthly budget? Is the loan tenure right for you? Before visiting a showroom or signing loan papers, it’s always smart to use an Auto EMI Calculator. This tool helps you figure out the monthly repayment amount for your car or bike loan — so you can plan better and stay stress-free.

👇 Try it now! 👇

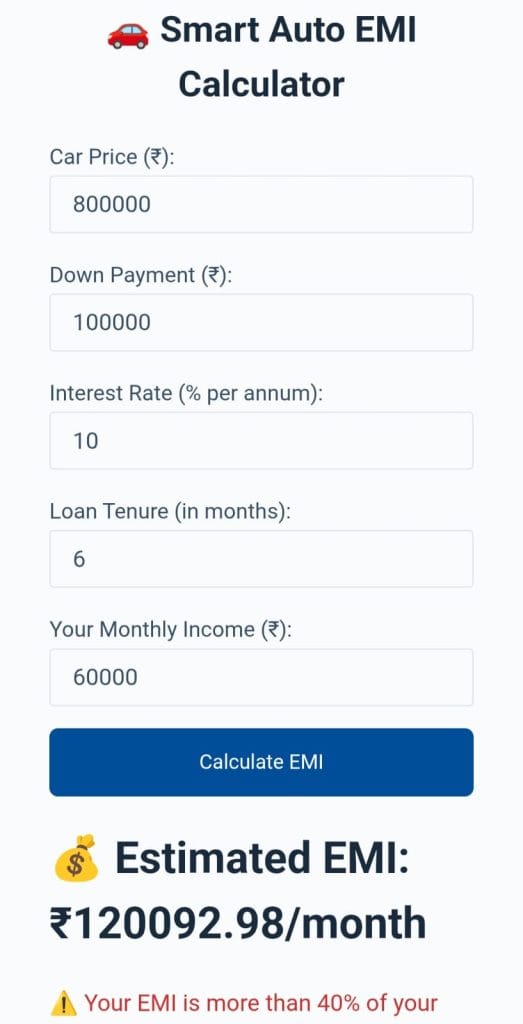

🚗 Smart Auto EMI Calculator

📊Result Preview📊

🤔 What is an Auto Loan?

An auto loan is the amount borrowed from a bank or lender to purchase a new or used vehicle, usually repaid over a period of 1 to 7 years in monthly installments (EMIs).

Banks usually finance up to 90% of the on-road vehicle price. You pay back in fixed EMIs, which include both:

- 🔢 The principal (actual loan amount)

- 💸 The interest charged by the lender

Auto loans are available for:

- 🚗 Cars (new or pre-owned)

- 🏍️ Two-wheelers

- 🚛 Commercial vehicles

💡 Why Use an Auto EMI Calculator?

Using this calculator helps you:

- Plan your budget properly before taking a loan

- Avoid getting into financial trouble later

- Compare EMIs for different banks, tenures, and interest rates

- Decide if the loan is worth it for the total repayment

It’s a free tool, takes just seconds, and gives you full clarity.

🧠 How is Auto EMI Calculated?

The formula used is the same as any EMI:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Principal amount (loan amount)

- R = Monthly interest rate

- N = Number of EMIs (months)

Don’t worry — you don’t need to do the math. Our Auto EMI Calculator does this instantly when you input the values.

🛠️ How to Use the Auto EMI Calculator

Just enter 3 simple details:

- Loan Amount (e.g., ₹5,00,000 for a car or ₹90,000 for a bike)

- Interest Rate (depends on the bank or NBFC)

- Loan Tenure (usually 1–7 years)

Click “Calculate”, and you’ll instantly see:

- Monthly EMI

- Total Interest Payable

- Total Repayment Amount

Try different values and find the best mix for your budget.

📊 Real-Life Example

Let’s say you’re buying a car and taking a ₹6,00,000 loan for 5 years at 10% interest.

🧾 Our Auto EMI Calculator will show:

- Monthly EMI: ₹12,748

- Total Interest: ₹1,64,880

- Total Repayment: ₹7,64,880

Now you can see the actual cost of the loan, not just the car.

🏍️ Useful for Bikes Too

Let’s say:

- Loan Amount: ₹80,000

- Tenure: 3 years

- Interest Rate: 12.5%

👉 You’ll pay around ₹2,671 per month in EMI.

This helps students and salaried users buying bikes to plan easily and avoid overborrowing.

🎯 Benefits of Using This Auto EMI Calculator

| Feature | Benefit |

|---|---|

| 🔍 Instant Results | No waiting — EMI shown instantly |

| 📱 Mobile-Friendly | Use easily on phones & tablets |

| 🔁 Try Multiple Options | Compare different tenures & interest rates |

| 💵 See Full Cost | Know total interest and repayment amount |

| 🧠 Smart Planning | Avoid financial stress post purchase |

🏦 Auto Loan Snapshot (India)

| Bank/Lender | Typical Interest Rate | Max Tenure | Processing Fee |

|---|---|---|---|

| HDFC Bank | 8.5% – 10.5% | 7 years | ₹2,999 – ₹4,999 |

| SBI Car Loan | 8.7% onwards | 7 years | 0.5% – 1% |

| Bajaj Auto Finance | 11% – 24% (bike loans) | 3 years | Varies |

| ICICI Bank | 9.5% onwards | 7 years | Up to ₹5,000 |

Note: These rates keep changing, always check official websites before applying.

🧾 Tips to Reduce Your Auto Loan EMI

- 💳 Improve your credit score

- 💸 Make a bigger down payment

- 📅 Choose a slightly longer tenure

- 🔄 Compare offers from 2–3 banks/NBFCs

- ✅ Opt for fixed interest rate if you’re unsure about rate hikes

❌ Mistakes to Avoid

| Mistake | Why It’s a Problem |

|---|---|

| Borrowing 100% of car price | Higher EMIs and interest |

| Ignoring processing fees | Adds to cost, not shown in EMI |

| Not checking prepayment terms | Some banks charge penalties |

| Choosing shortest tenure blindly | EMI may become too high for comfort |

💬 FAQs

Q: Is this tool for both cars and bikes?

Yes! You can calculate EMI for any vehicle loan — cars, bikes, scooters, etc.

Q: Is the result accurate?

Yes, it uses the standard EMI formula. Results are accurate based on your input.

Q: Will this affect my CIBIL or credit score?

No. This is just a calculator. It doesn’t require login or any sensitive data.

Q: Can I use this on mobile?

Absolutely — the tool is built mobile-first for quick use.

✍️ Final Words

Buying a vehicle is a big step, especially for young earners or first-time buyers. Don’t let EMIs surprise you later. Always use this Auto EMI Calculator to see what you’re getting into.

Whether it’s a dream bike or your first car, this tool helps you budget smartly, avoid over-spending, and compare before applying for any loan.

Try different combinations, see what works, and pick a loan that fits your life — not just your wishlist 🚗📉✅