📉 EMI Calculator – Plan Your Loans Like a Pro (Before You Borrow)

Taking a loan sounds easy, right? Just fill a form, wait a few hours, and boom — money in your account. But wait… how much do you actually pay every month? What will be your EMI? Can you afford it without affecting your monthly life? That’s where an EMI Calculator comes into play.

👇 Try it now! 👇

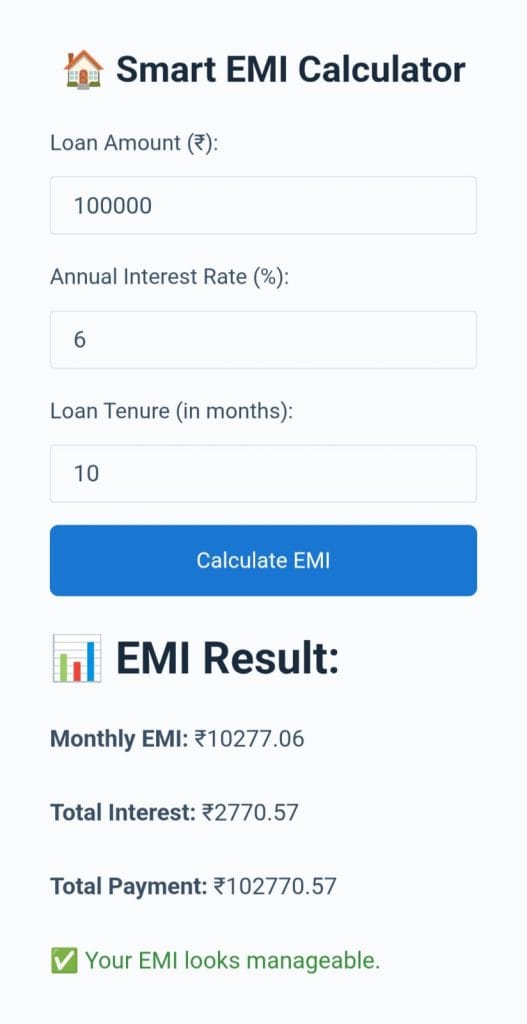

🏠 Smart EMI Calculator

📊Result Preview📊

Before applying for any loan — be it a home loan, personal loan, car loan, or even education loan, it’s super important to calculate your EMI. It helps you stay prepared, budget wisely, and avoid financial stress later on.

Let’s explore everything you need to know about EMIs, and how to use this free EMI calculator effectively.

🔎 What Is EMI?

EMI stands for Equated Monthly Installment. It’s the fixed amount of money you have to pay every month to repay your loan, until the full amount (including interest) is covered.

Your EMI includes:

- The Principal – the amount you borrowed

- The Interest – charged by the lender over time

Both combined are split evenly over the loan tenure (in months). So, every month, a portion goes toward interest, and the rest reduces your principal.

🧠 EMI Formula (If You’re Curious)

You don’t have to do this manually, but here’s the standard formula used:

EMI = [P x R x (1+R)^N] / [(1+R)^N – 1]

Where:

P = Principal loan amount

R = Monthly interest rate (Annual interest ÷ 12 ÷ 100)

N = Number of monthly installments (loan tenure in months)

Don’t worry, our calculator does this instantly.

🛠️ How to Use the EMI Calculator

You just need to enter 3 simple things:

- 💰 Loan Amount – how much you’re borrowing (₹10,000 – ₹10,00,000+)

- 📅 Tenure – loan duration in months or years (1 year to 30 years)

- 📈 Interest Rate – based on your bank/lender’s offer

👉 Once you hit “Calculate”, you’ll instantly see:

- Monthly EMI

- Total interest payable

- Total repayment amount

📊 Example Use Case

Let’s say:

- Loan amount: ₹5,00,000

- Tenure: 5 years

- Interest rate: 12%

🧾 Our EMI Calculator shows:

- EMI: ₹11,122

- Total interest: ₹1,67,310

- Total repayment: ₹6,67,310

This gives a clear picture before you sign any papers.

🎯 Why Use an EMI Calculator?

| Reason | Benefit |

|---|---|

| 🎯 Better Budget Planning | Know exactly how much will go from your income every month |

| 💸 Avoid Over-Borrowing | Don’t borrow more than you can handle |

| 🧠 Quick Comparison | Try different interest rates and tenures instantly |

| 📈 See the Total Cost of the Loan | It’s not just EMI — total interest adds up too |

| 🔁 Try Multiple Scenarios | What if you reduce tenure? What if you increase it? Play and plan smart |

🏦 Who Should Use an EMI Calculator?

This tool is useful for anyone planning to take:

- 🏡 Home Loan

- 🚗 Car or Two-Wheeler Loan

- 💼 Business Loan

- 📚 Education Loan

- 💳 Personal Loan

- 🛒 Even Buy Now Pay Later (BNPL) offers

Basically, if there’s a loan or credit involved — use this EMI calculator first.

📉 What Affects EMI?

There are 3 major factors:

- Loan Amount – higher amount = higher EMI

- Interest Rate – higher interest = higher EMI

- Tenure – longer tenure = lower EMI (but more interest paid)

So it’s a balancing game between how much EMI you can afford and how much total you’re ready to pay.

💡 Tips to Manage EMI Smartly

- ✅ Try keeping EMIs under 40% of your net income

- ✅ Pick a comfortable tenure — not too short, not too long

- ✅ Use part-prepayment if possible (to close loan early)

- ✅ Don’t miss EMI dates — it affects your credit score

- ✅ Compare banks using our calculator before choosing

❌ Common Mistakes People Make

| Mistake | Why It’s Bad |

|---|---|

| Taking max possible loan | Leaves no room for emergency expenses |

| Choosing lowest tenure | EMI becomes very high |

| Ignoring processing charges | Actual cost becomes more |

| Not using a calculator | You have no idea what you’re signing up for |

💬 FAQs

Q: Is this EMI calculator only for personal loans?

Nope! You can use it for home loans, car loans, education loans, BNPL, and even credit card EMIs.

Q: Does this affect my credit score?

Not at all. It’s just a free tool to help you calculate — no data is stored, and no checks are done.

Q: Can I use this on mobile?

Yes! This tool is fully mobile-friendly and responsive.

Q: Is this calculator accurate?

Absolutely. It uses the same EMI formula banks use.

✍️ Final Thoughts on EMI Calculator

Loans are helpful. But EMIs are a long-term commitment, sometimes for 5, 10, or even 20 years. The worst thing is to realize you’ve committed more than you can repay. That’s why a simple tool like this EMI Calculator can literally save your financial life.

Don’t borrow blindly. Plug in your numbers, calculate your EMI, and adjust until it fits your budget. Then — and only then — go to the bank.

Try it now. It’s free, fast, and helps you make smarter loan decisions. 💼📉✅