🏠 HDFC Housing Loan Calculator – Know Your Home Loan EMI Before You Commit

Thinking of buying your dream house? 🏡 Whether it’s your first home or an upgrade, HDFC housing loans are one of the most popular choices in India. But before you jump into any commitment, one big question needs answering — how much will the EMI be? That’s why we built this HDFC Housing Loan Calculator — a simple tool that helps you calculate your monthly EMI in seconds, so you know exactly what you’re signing up for.

👇 Try it now! 👇

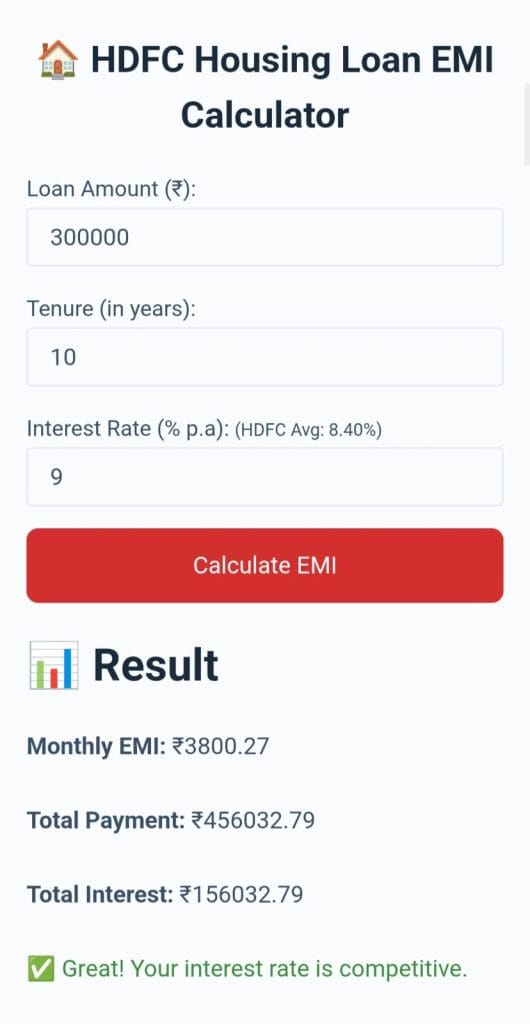

🏠 HDFC Housing Loan EMI Calculator

📊Result Preview📊

🧾 What Is a Housing Loan?

A housing loan, or home loan, is the amount borrowed from a bank or lender (like HDFC) to purchase, construct, or renovate a residential property. You repay this loan over time through monthly EMIs (Equated Monthly Installments) that include both the principal (loan amount) and interest.

Banks like HDFC offer housing loans with:

- Long tenures (up to 30 years)

- Lower interest rates (starting around 8.5%)

- Flexible repayment options

But knowing how much EMI you’ll have to pay every month is key before applying.

🤔 Why Use the HDFC Housing Loan Calculator?

The answer’s simple: To avoid surprises.

When you know your EMI:

- You can plan your monthly budget

- Avoid loan rejection

- Compare different tenure/interest options

- Check affordability before you apply

This calculator helps you do all that — with zero stress.

🧠 How Is Home Loan EMI Calculated?

The formula behind EMI is:

EMI = [P x R x (1+R)^N] / [(1+R)^N – 1]

Where:

- P = Loan amount

- R = Monthly interest rate (annual rate ÷ 12 ÷ 100)

- N = Number of monthly installments

Don’t worry — our calculator does all that math for you.

🛠️ How to Use This HDFC Housing Loan Calculator

Enter the following:

- 🏦 Loan Amount (e.g., ₹30,00,000)

- 📅 Tenure in years (e.g., 20 years)

- 📈 Interest Rate (HDFC’s current rate or custom rate)

Click “Calculate” and instantly see:

- Monthly EMI

- Total Interest Payable

- Total Loan Repayment

Plus, adjust values to test different scenarios.

📊 Real-Life Example

Let’s say you’re planning to take a ₹40,00,000 loan from HDFC for 20 years at 8.7% interest.

👉 Our HDFC housing loan calculator shows:

- EMI: ₹35,169

- Total Interest: ₹44,40,592

- Total Repayment: ₹84,40,592

This means you’re paying almost as much in interest as the principal itself — something most people don’t realize without a calculator.

🧾 Benefits of Using This Calculator

| Feature | Why It Helps You |

|---|---|

| 🔍 Instant EMI | Get monthly EMI without complex math |

| 📈 Interest insight | Know exactly how much interest you pay |

| 📆 Tenure planning | Try different years and see impact |

| 💡 Better budgeting | Align your loan with income |

| 🏦 Bank comparison | Try HDFC’s rate vs others |

🧮 Key Inputs Explained in HDFC Housing Loan Calculator

📌 Loan Amount

This is the amount you plan to borrow from HDFC. You can change it to see how EMI changes with different loan sizes.

📌 Loan Tenure

Most people go for 15 to 30 years. A longer tenure = lower EMI but more interest.

📌 Interest Rate

HDFC’s home loan rates start around 8.5% and vary based on credit score, salary, and loan type. You can also try custom rates for testing.

❌ Common Mistakes People Make

- Picking shortest tenure to “save time” → High EMI!

- Ignoring total interest → Pay lakhs extra unknowingly

- Not checking bank’s latest rates

- Assuming pre-approval means full approval

This calculator helps you avoid all of these.

🏦 HDFC Home Loan Features (At a Glance)

| Feature | HDFC Offering (Typical) |

|---|---|

| Interest Rate | 8.5% – 9.5% per annum (floating/fixed) |

| Tenure | Up to 30 years |

| Loan Amount | ₹1 lakh to ₹10+ crore |

| Processing Fee | Usually 0.5% of loan |

| Prepayment Charges | 0% for floating rate loans |

These can vary based on promotions and offers, so always check HDFC’s official site before applying.

💬 FAQs

Q: Is this calculator only for HDFC?

No, it works for any housing loan. But we’ve customized defaults for HDFC’s typical rates.

Q: Is the EMI shown final?

It’s an estimate based on standard formulas. Final numbers may differ based on processing fees, credit profile, etc.

Q: Will using this calculator affect my credit score?

Not at all! It’s 100% free, private, and doesn’t do any credit check.

Q: Can I use it for balance transfer?

Yes, you can use it to compare new EMIs if switching from another bank to HDFC.

📝 Final Words on HDFC Housing Loan Calculator

Buying a home is a big step — and probably one of the biggest investments of your life. You don’t want to walk into a 20-year loan blind. Knowing your monthly EMI, the total interest, and planning your finances makes the journey smoother.

This HDFC Housing Loan Calculator gives you the clarity you need — no jargon, no tricks. Just simple numbers that help you decide confidently.

Before you apply for that home loan — run the numbers here. Even a small change in tenure or rate can make a big difference in your monthly payments and total interest.

Try the calculator now. Plan smart. Buy confidently. 🏠💸