🏡 Home Loan EMI Calculator – Plan Before You Purchase

Buying a home is a dream for most people. Whether it’s your first apartment or a spacious house for your family, owning property is a big milestone. But it’s also one of the biggest financial decisions you’ll make. This free Home Loan EMI Calculator helps you calculate your EMI, total interest, and total repayment amount — so you can plan your home loan smartly, without surprises later.

👇 Try it now! 👇

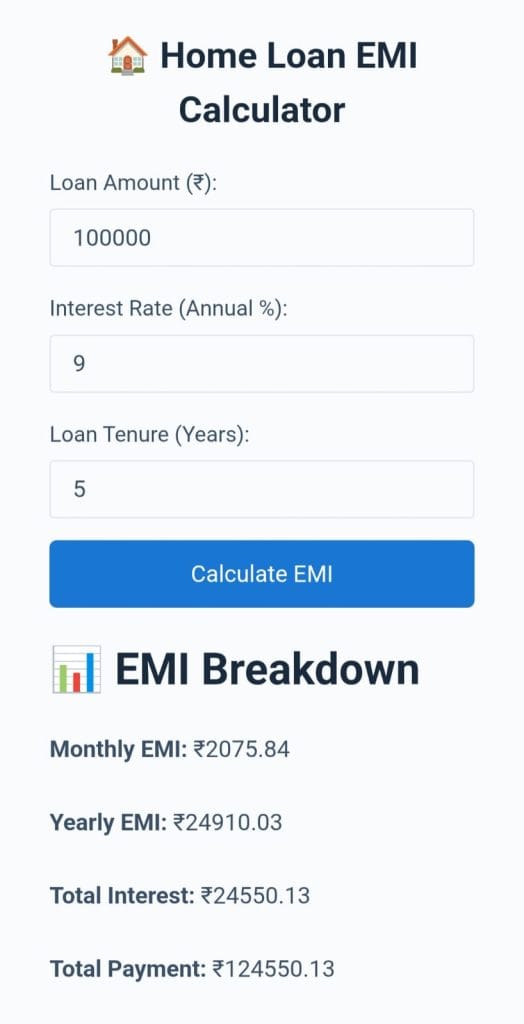

🏠 Home Loan EMI Calculator

📊Result Preview📊

❓ What Is a Home Loan EMI Calculator?

EMI stands for Equated Monthly Installment. It’s the amount you’ll pay every month to repay the loan, which includes:

- 🏦 Loan principal (amount you borrowed)

- 💸 Interest (charged by the bank)

Your EMI stays fixed if you’re on a fixed interest rate, or it may vary if the rate is floating. Either way, you can calculate an estimate with this tool.

🧠 EMI Formula Used in the Home Loan EMI Calculator

We use the same standard EMI formula that most Indian banks and financial institutions follow:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Loan amount

- R = Monthly interest rate (annual ÷ 12 ÷ 100)

- N = Loan tenure in months

No need to worry about the math — this tool handles it all for you instantly.

🔢 How to Use the Home Loan EMI Calculator

Just enter these 3 simple details:

- Loan Amount – Example: ₹40,00,000

- Interest Rate – Example: 8.5% per annum

- Loan Tenure – Example: 20 years

Then click “Calculate”, and you’ll see:

- 🧾 Monthly EMI

- 💰 Total interest payable

- 🧮 Total repayment (loan + interest)

Try different combinations to find the plan that suits your monthly budget.

📊 Real-Life Example

Let’s say:

- Loan: ₹40,00,000

- Interest Rate: 8.5%

- Tenure: 20 years

👉 Your result will be:

- EMI: ₹34,676/month

- Total Interest: ₹43,22,254

- Total Repayment: ₹83,22,254

You can now clearly see how much you’re actually paying over 20 years. This helps you plan better and avoid overborrowing.

🏦 Typical Home Loan Terms in India

| Feature | Common Range/Value |

|---|---|

| Loan Amount | ₹5 lakh to ₹5 crore (based on eligibility) |

| Interest Rate | 8% to 10.5% (varies by lender & credit score) |

| Tenure | Up to 30 years |

| Processing Fee | 0.25% – 1% of loan amount |

| Prepayment Option | Allowed (partial or full) |

| Eligibility | Based on income, job, CIBIL score, property value |

💡 Why Use the Home Loan EMI Calculator?

| Benefit | How It Helps |

|---|---|

| 📊 Get Clear EMI Estimate | Plan monthly budget easily |

| 🔄 Compare Loan Scenarios | Adjust tenure & interest rates |

| 🧾 Total Interest Visibility | Know the real cost of the loan |

| 💰 Prevent Overborrowing | Borrow only what you can repay |

| 🧠 Better Financial Planning | Avoid future repayment stress |

Whether you’re applying at SBI, HDFC, ICICI, Axis, or any NBFC — this calculator works for all.

❌ Common Mistakes People Make

| Mistake | Why It’s Costly |

|---|---|

| Choosing longest tenure | Lower EMI, but much higher interest |

| Ignoring total interest | Ends up paying more than expected |

| Taking max loan possible | No buffer for other expenses |

| Not checking floating vs fixed | Can affect EMI in long term |

This calculator prevents these mistakes by giving a clear picture in seconds.

📉 How to Reduce Your EMI Burden

- 💳 Improve your CIBIL score to get a lower rate

- 💸 Make a higher down payment

- ⏳ Choose a slightly shorter tenure (if you can manage)

- 🔁 Prepay your loan when you get extra money

- 🔄 Balance transfer to another bank with lower rate

Even reducing EMI by ₹1,000/month can save lakhs over 20 years!

🧾 Loan Components This Calculator Covers

- ✅ Loan principal

- ✅ Interest over time

- ✅ Total loan cost

- ✅ Impact of tenure

- ✅ Monthly repayment amount

You can change values easily and compare multiple scenarios.

💬 FAQs

Q: Can I use this calculator for floating interest loans?

Yes. Just enter the average or expected rate — it will give an approximate EMI.

Q: Does this calculator save my data?

No, it’s fully private. We don’t store or track any user data.

Q: Will this affect my credit score?

Not at all. It’s just a planning tool and doesn’t touch your credit report.

Q: Can I use this for a joint home loan?

Yes! The loan amount and EMI stay the same — just divide responsibility between co-applicants.

✍️ Final Thoughts on Home Loan EMI Calculator

Taking a home loan is one of the longest financial commitments you’ll make — often for 15 to 30 years. Even small mistakes in loan amount, tenure, or rate can cost you lakhs of rupees.

This Home Loan EMI Calculator is your first step toward a well-planned, stress-free home buying journey. Use it to estimate your EMI, test different plans, and make smart, confident choices.

✅ It’s fast. ✅ It’s free. ✅ It’s mobile-friendly. Try it now and plan your dream home without surprises.