🧾 Loan Eligibility Calculator – Know How Much You Can Borrow Before You Apply

Planning to apply for a personal loan, home loan, or car loan? Before you fill out that form, it’s smart to check how much loan you’re eligible for. That’s where this Loan Eligibility Calculator comes in handy. It quickly shows how much loan amount you can get based on your monthly income, current EMIs, interest rate, and loan tenure.

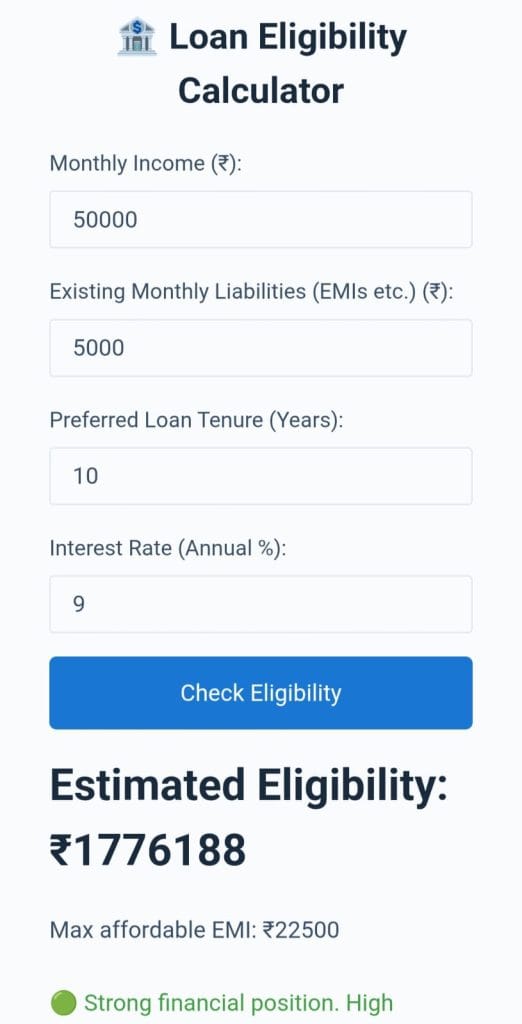

👇 Try it now! 👇

🏦 Loan Eligibility Calculator

📊Result Preview📊

This helps you avoid loan rejections, unnecessary credit checks, and saves your time and effort.

🧠 What Is Loan Eligibility?

Loan eligibility is simply the maximum loan amount a lender is willing to give you, based on your financial profile.

It depends on several factors:

- 💸 Your monthly income

- 💳 Existing EMIs or credit card dues

- 🧾 Loan tenure you choose

- 🏦 Interest rate offered by the bank

- 💼 Your employment type (salaried or self-employed)

- 📊 Your credit score (CIBIL score)

Each lender uses their own formula, but the logic is roughly the same: Can this person repay comfortably or not?

🧮 What Does This Calculator Do?

This Loan Eligibility Calculator helps you estimate:

- ✅ Maximum loan amount based on income

- ✅ What EMI you can afford

- ✅ How different tenures or rates affect eligibility

- ✅ Whether you’re ready for a big loan or not

It gives an idea of how much you can safely borrow without overburdening your monthly budget.

🔢 Inputs You Need to Enter

To get started, just enter:

- Monthly Income – Your take-home salary or business income

- Monthly EMIs – Ongoing loan payments or credit card EMIs

- Loan Tenure – In years (example: 5, 10, or 20 years)

- Interest Rate – Approximate rate offered by banks

👉 Hit “Calculate”, and you’ll see the eligible loan amount instantly.

You can change values and try different options to plan better.

📊 Example Scenario

Let’s say:

- Monthly Income = ₹60,000

- Existing EMI = ₹5,000

- Interest Rate = 10%

- Tenure = 5 years

👉 You’re eligible for a loan of around ₹8.4 lakhs

Your EMI would be ~₹17,825/month

This means you can easily manage this EMI while keeping other expenses in check.

🏦 How Banks Check Loan Eligibility

Most banks use the FOIR (Fixed Obligations to Income Ratio) formula:

Eligible EMI = (60% of income) – current EMIs

Loan Amount = EMI-based formula using rate & tenure

For high earners or govt. employees, banks may allow up to 65-70% FOIR.

CIBIL score is also checked, but this tool does not impact your credit score — it’s just a calculator.

📉 How to Increase Your Loan Eligibility

| Strategy | Why It Works |

|---|---|

| 💳 Reduce existing EMIs | Frees up income for new loan |

| ⏳ Choose longer tenure | Lowers EMI, increases loan amount |

| 💼 Include co-applicant | Combines income of both applicants |

| 📈 Improve credit score | Qualifies you for better offers |

| 🧾 Declare additional income | Rental or freelance income helps |

Even small changes can increase eligibility by lakhs!

❌ Mistakes to Avoid

| Mistake | Risk Involved |

|---|---|

| Applying without checking | Loan rejection or low approval |

| Not disclosing existing EMIs | Can backfire during bank check |

| Overestimating income | May face trouble during documentation |

| Underestimating expenses | EMI stress later |

This calculator ensures you’re realistic and safe before applying.

💡 Why Use This Calculator Before Applying?

| Benefit | Result |

|---|---|

| 🎯 Know your limits | Borrow smart, not just big |

| 🧠 Avoid stress later | Plan EMI in advance |

| 🏦 Compare loan types | Try home, personal, or car loan values |

| 🚫 Avoid hard inquiries | No impact on credit score |

| 📱 Works on mobile too | Calculate anytime, anywhere |

It’s fast, free, and super useful for anyone thinking about a loan.

💬 FAQs on Loan Eligibility Calculator

Q: Does this tool give real bank approval?

No. This is just a calculator to estimate your eligibility. Final decision depends on banks.

Q: Will this affect my credit score?

Not at all. We don’t store your info or report anything to credit agencies.

Q: Can I use this for home, personal, or car loans?

Yes! The logic is same — just enter relevant details and you’ll get results.

Q: What if I have variable income?

You can take an average of 6 months’ income to calculate.

✍️ Final Thoughts on Loan Eligibility Calculator

Applying for a loan without knowing your limits is like shopping with no money in your wallet — it leads to disappointment or even rejection.

Use this Loan Eligibility Calculator to understand how much you can borrow safely. Adjust your expectations, tweak your plans, and make informed financial decisions.

It’s your money, your future, and your peace of mind. ✅