💸 Personal Loan EMI Calculator – Plan Your Loan Repayment the Smart Way

Need funds for an emergency, wedding, travel, or anything urgent? A personal loan is one of the fastest and easiest ways to get money. But the big question is — how much will you repay every month? That’s where this Personal Loan EMI Calculator helps you. It instantly shows your monthly EMI, total interest, and total repayment — so you don’t get shocked later.

👇 Try it now! 👇

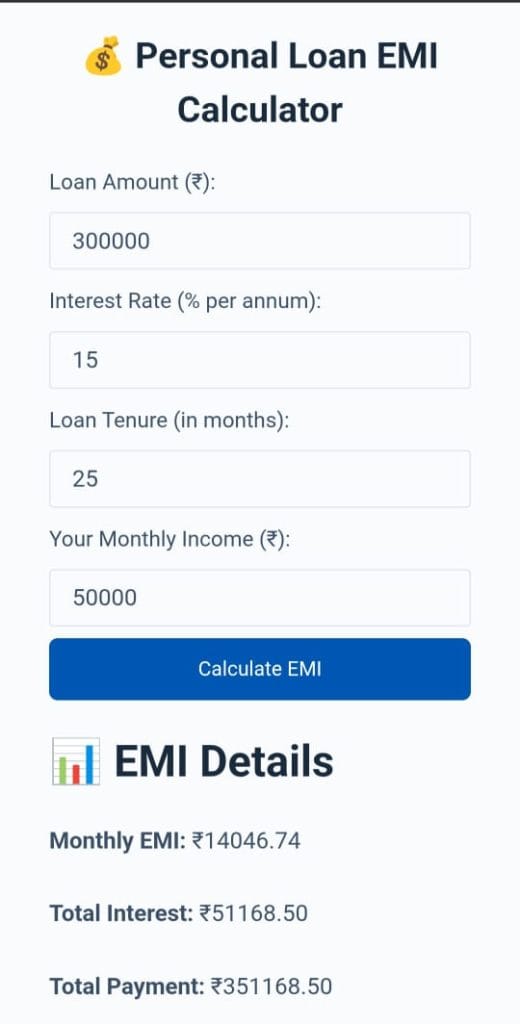

💰 Personal Loan EMI Calculator

📊Result Preview📊

Whether you’re borrowing ₹50,000 or ₹20 lakh, this tool helps you plan better and borrow smarter.

❓ What Is a Personal Loan?

A personal loan is an unsecured loan — that means no need to pledge collateral or assets. It’s given based on:

- Credit score

- Income

- Loan repayment history

- Employer and city

You can use it for:

- 💍 Weddings

- 🏥 Medical expenses

- ✈️ Travel

- 📚 Education

- 🛋️ Home renovation

- 🛒 Shopping or bills

Since it’s unsecured, the interest rate is usually higher than home or auto loans — making EMI calculation even more important.

💡 Why Use a Personal Loan EMI Calculator?

Here’s why this free tool is useful:

| Reason | Benefit |

|---|---|

| 📊 Know Your EMI Instantly | Avoid surprises after loan approval |

| 🧾 Get Total Interest Shown | See how much you’ll really repay |

| 🧮 Try Different Scenarios | Find the best loan amount & tenure |

| 🧠 Make Smart Decisions | Borrow only what you can handle |

| 🪙 Budget Monthly Expenses | Plan repayments without stress |

No registration. No credit check. Just pure math in seconds.

🧠 EMI Formula Used

We use the standard EMI formula followed by banks and NBFCs:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual ÷ 12 ÷ 100)

- N = Loan tenure in months

The tool does all the calculations — just enter your values.

🛠️ How to Use the Personal Loan EMI Calculator

Just enter:

- Loan Amount (e.g., ₹1,00,000)

- Interest Rate (e.g., 12.5%)

- Tenure (in months or years)

💥 Click “Calculate”, and you’ll see:

- Monthly EMI

- Total Interest

- Total Repayment (EMI × months)

You can change the numbers to compare different options instantly.

📊 Real Example

Say you’re borrowing ₹3,00,000 for 3 years at 13% interest.

👉 Our calculator shows:

- EMI: ₹10,110

- Total Interest: ₹63,960

- Total Repayment: ₹3,63,960

That’s over ₹60K in interest — now you know exactly what it costs before applying.

🔎 Typical Personal Loan Details in India

| Bank/Lender | Interest Rate (Approx.) | Tenure | Loan Amount |

|---|---|---|---|

| SBI | 11.00% – 14.00% | Up to 6 years | ₹24K – ₹20 lakh |

| HDFC Bank | 10.50% – 21.00% | Up to 5 years | ₹50K – ₹40 lakh |

| ICICI Bank | 10.99% – 17.99% | Up to 6 years | ₹1 lakh – ₹25 lakh |

| Bajaj Finance | 12.99% – 25.00% | Up to 5 years | ₹30K – ₹25 lakh |

These are average rates — they vary based on your credit profile.

📉 Tips to Reduce Your EMI

- 💳 Maintain a good credit score (700+ preferred)

- ⏱️ Choose a slightly longer tenure (but more interest overall)

- 🪙 Borrow only what you truly need

- 🏦 Compare bank/NBFC rates before choosing

- 🔁 Make prepayments when possible

❌ Common Mistakes to Avoid

| Mistake | Why It’s Risky |

|---|---|

| Not checking total repayment | May end up repaying way more |

| Choosing max tenure blindly | EMI is low, but total cost increases |

| Not comparing lender rates | Miss out on better deals |

| Taking more than needed | More EMI burden for no real reason |

This calculator keeps you informed so you borrow responsibly.

🧾 Benefits of Using Our EMI Calculator

- ✅ Completely free to use

- ✅ Mobile-friendly & quick

- ✅ No sign-up, no personal data required

- ✅ Works for all banks and NBFCs

- ✅ Ideal for salaried, self-employed, and freelancers

💬 FAQs

Q: Can I use this calculator for any bank’s personal loan?

Yes, just enter the interest rate your bank/NBFC is offering.

Q: Are the results accurate?

Absolutely — we use the exact EMI formula banks use.

Q: Will it affect my CIBIL or credit score?

Nope! This tool doesn’t collect any personal or financial data.

Q: Can I change tenure easily?

Yes, increase or decrease tenure and recalculate to see EMI impact.

✍️ Final Thoughts on Personal Loan EMI Calculator

Getting a personal loan is quick and easy — but repaying it every month needs solid planning. Even a small mistake in choosing tenure or amount can lead to financial stress.

This Personal Loan EMI Calculator is the simplest way to understand your loan cost and adjust it to fit your life. Whether you’re planning a wedding, going on a trip, or handling an emergency — this tool puts you in control.

Use it before you apply. Compare, calculate, and borrow confidently. ✅