💰 PL Loan EMI Calculator – Know Your EMI Before You Borrow

So you’re planning to take a personal loan (PL)? It’s a smart option when you need quick money — be it for a medical emergency, marriage, travel, or anything else. But the first thing most people worry about is… “How much will I have to pay every month?” That’s exactly why we made this PL Loan EMI Calculator — so you can calculate your monthly EMI before applying, and plan better without getting surprises later.

👇 Try it now! 👇

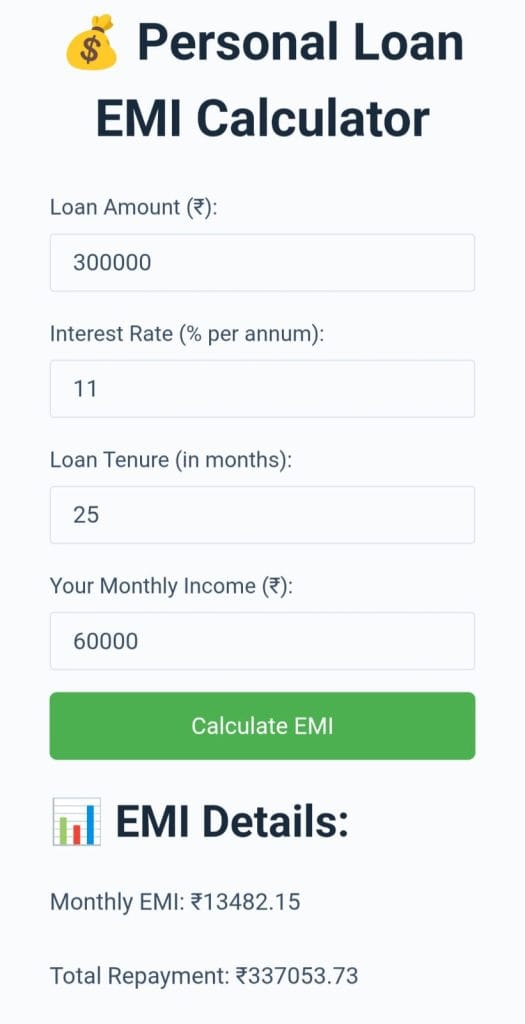

💰 Personal Loan EMI Calculator

📊Result Preview📊

🤔 What Is a Personal Loan (PL)?

A personal loan is an unsecured loan you can take from a bank, NBFC, or digital lender without giving any security like property or gold. It’s usually quick, needs basic paperwork, and money gets credited fast — sometimes in just 24 hours.

But being unsecured also means interest rates are higher than home or car loans — usually between 10% and 25% depending on your credit score, income, and lender.

📉 What Is EMI in PL?

EMI stands for Equated Monthly Installment — it’s the fixed amount you pay every month to repay the loan. It includes both:

- 💸 Principal (the amount you borrowed)

- 🧾 Interest (charged by the bank)

So your monthly EMI depends on:

- Loan amount (₹1 lakh, ₹2 lakh, etc.)

- Tenure (1 to 5 years usually)

- Interest rate (bank-dependent)

🧠 How EMI Is Calculated?

The formula is actually simple but long:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1]

Where:

P = Loan amount

R = Monthly interest rate

N = Number of months

No need to worry though — our PL Loan EMI Calculator does it all for you behind the scenes. Just enter a few values, and boom — you get your EMI instantly.

🧪 Try the PL Loan EMI Calculator Now

Just input:

- 💵 Loan amount (e.g., ₹1,50,000)

- 📅 Loan tenure (in years)

- 🔢 Interest rate (e.g., 13.5%)

Click Calculate and you’ll get:

- Monthly EMI

- Total interest payable

- Total amount you’ll repay

It also gives tips if your EMI is too high or too low based on your income range.

✅ Mobile-friendly

✅ Works instantly

✅ No data collected — totally private

📊 Example Scenario

Let’s say:

- You want ₹2,00,000

- Tenure: 3 years

- Interest: 14%

👉 Our calculator shows:

- Monthly EMI: ₹6,836

- Total Interest: ₹45,063

- Total Repayment: ₹2,45,063

Now you know what you’re getting into — no guessing, no shock later.

💡 Why Should You Use an EMI Calculator?

- 🧾 Better Financial Planning

You’ll know exactly how much goes out every month. - ❌ Avoid Loan Rejection

If the EMI is too high for your income, banks may reject. You can adjust before applying. - 📈 Compare Lenders

Try different interest rates and choose the cheapest one. - 🧠 Stress-free Decisions

No “What if I can’t pay?” moments later.

🧮 How to Choose the Right EMI?

Here’s a simple rule:

👉 Try to keep your total EMIs below 40–50% of your net monthly income.

So, if you earn ₹50,000/month:

- Safe EMI = ₹20,000–₹25,000 max

- Go lower if you have other EMIs or family responsibilities

❌ Mistakes People Make with PL EMIs

- Taking max loan just because you’re eligible

- Not checking total repayment (not just EMI)

- Choosing shortest tenure to finish faster = high EMI

- Not comparing lenders

Our tool shows both monthly EMI and total repayment, so you don’t fall into these traps.

✅ Features of Our PL Loan EMI Calculator

| Feature | Description |

|---|---|

| ⚡ Instant result | No waiting, loads in seconds |

| 📱 Mobile-ready | Perfect for phones and tablets |

| 🔐 No login/data | We don’t store anything you type |

| 🧾 Full breakdown | EMI, interest, total repayment |

| 📊 Smart alerts | Suggestions if EMI is too high |

🔄 Can You Prepay a PL?

Yes! You can repay a personal loan before time, but some banks may charge a prepayment penalty (usually 2–5%).

Our tool doesn’t handle prepayment yet, but we’re planning to add that soon.

💬 FAQs

Q: Can I use this for HDFC/ICICI/Bajaj personal loans?

Yes! This works for all personal loans — just adjust the interest rate your bank is offering.

Q: Is it accurate?

100% — it follows the standard EMI formula used by banks.

Q: Is this free to use?

Yes! No login, no tracking, no annoying ads. Just simple EMI calculation.

📝 Final Thoughts on PL Loan Emi Calculator

Taking a personal loan is easy these days, but repayment is where things get real. So before applying, make sure you understand the cost — not just how much you borrow, but how much you repay.

With our PL Loan EMI Calculator, you’re not just punching numbers — you’re making an informed decision that saves stress, money, and time. Try it now, tweak values, and pick an EMI you can live with comfortably.

Planning smart = borrowing smart 💼✅