🏦 Mortgage Loan Calculator SBI – Plan Your EMI Before You Apply

Need a mortgage loan from SBI? Whether you’re pledging property to get funds for business, personal needs, or anything else — it’s a smart move, but only if you understand how much you’ll pay back every month.That’s where this Mortgage Loan Calculator SBI comes in handy. 🎯

👇 Try it now! 👇

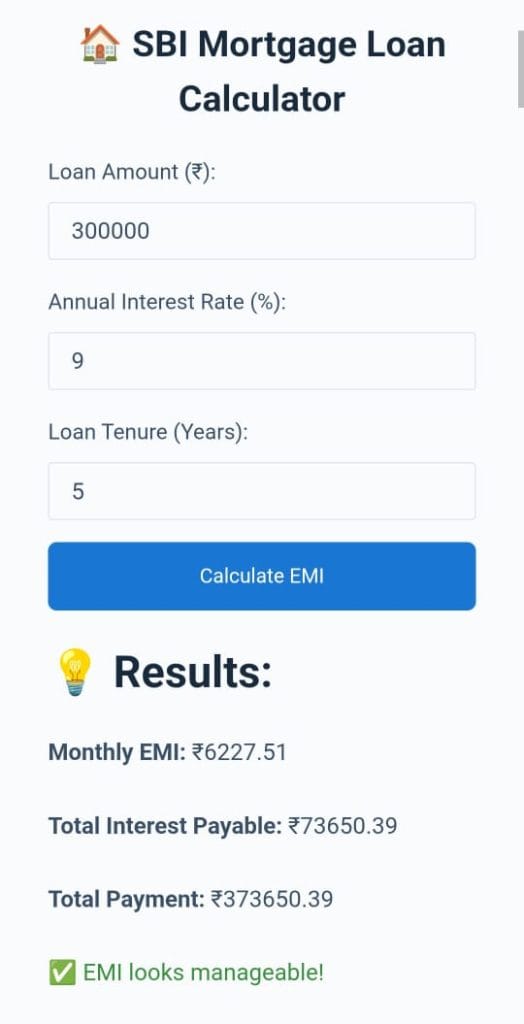

🏠 SBI Mortgage Loan Calculator

📊Result Preview📊

It gives you a quick and clear idea of your monthly EMI, total interest, and total repayment based on SBI’s latest interest rates and terms. Whether you’re a salaried person or self-employed, this tool helps you make confident decisions before applying.

🧾 What Is a Mortgage Loan?

A mortgage loan is a type of secured loan where you pledge your residential or commercial property to get funds. SBI offers this under the name “Loan Against Property (LAP)” or “Mortgage Loan”.

You can use the funds for:

- Expanding business

- Child’s education

- Medical emergencies

- Wedding expenses

- Any large personal or professional need

The biggest benefit? SBI offers lower interest rates since the loan is secured by your property.

📈 Why Use the SBI Mortgage EMI Calculator?

Taking a mortgage loan means committing to monthly EMIs for 10 to 15 years, or more. Without planning, this can disturb your budget badly.

Using this calculator helps you:

- ✅ Find the monthly EMI instantly

- ✅ See the total interest over time

- ✅ Choose the best tenure & loan amount

- ✅ Compare different rates & repayment strategies

All this without doing any complex math.

🧠 EMI Formula Used (No Need to Do It Yourself)

We use the standard EMI formula used by SBI and other banks:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Loan amount

- R = Monthly interest rate (annual ÷ 12 ÷ 100)

- N = Number of months

But don’t worry — our calculator handles all this automatically for you.

🛠️ How to Use the Mortgage Loan Calculator SBI

Simply enter:

- 🏠 Loan Amount – how much you want to borrow

- 📅 Tenure – number of years you’ll repay (up to 15 years)

- 💰 Interest Rate – SBI’s current rate or a custom one

Then just hit “Calculate”.

You’ll get:

- Your monthly EMI

- Total interest payable

- Total repayment amount (Principal + Interest)

Play with values to see what fits your monthly budget.

📊 Example Scenario

Let’s say:

- Loan Amount: ₹20,00,000

- Tenure: 15 years

- Interest Rate: 10.50%

👉 You’ll get:

- EMI: ₹22,013/month

- Total Interest: ₹19,62,385

- Total Repayment: ₹39,62,385

That’s almost double the principal! This is why calculating in advance is so important.

🏦 SBI Mortgage Loan – Key Details

| Feature | SBI Typical Offer (2024–25) |

|---|---|

| Max Loan Amount | ₹10 lakh to ₹7.5 crore |

| Interest Rate | 10.15% – 11.55% (may vary) |

| Processing Fee | Up to 1% or ₹10,000 (approx) |

| Maximum Tenure | Up to 15 years |

| Type of Property | Residential, commercial, industrial |

| Eligible Applicants | Salaried, self-employed, businesses |

Note: These values change often — always verify from SBI’s official site.

📉 Benefits of Using This Calculator

| Reason | How It Helps You |

|---|---|

| 🧾 No Surprises Later | Know EMI & total interest upfront |

| 🏃 Compare Scenarios Fast | Try different amounts & tenures |

| 💡 Better Decision Making | Borrow what you can really repay |

| 📊 Financial Planning | Set monthly budget with clarity |

| 🔁 Prepayment Planning | See how shorter tenure affects EMI |

❌ Common Mistakes People Make

| Mistake | Why It’s Risky |

|---|---|

| Taking too big a loan | EMIs eat into monthly needs |

| Ignoring total interest | You may pay double the loan |

| Choosing longest tenure blindly | EMI goes down, but interest rises |

| Skipping pre-check like this tool | May lead to loan rejection |

This calculator saves you from making these common financial mistakes.

💬 FAQs

Q: Is this calculator only for SBI?

The defaults are tuned for SBI, but you can use this tool for any bank by adjusting the interest rate.

Q: Is this tool accurate?

Yes, it uses standard formulas accepted by all major Indian banks.

Q: Will it affect my credit score?

No! It’s a free tool and doesn’t collect any data or do credit checks.

Q: Can I use this for joint loans?

Yes, calculate for the full loan amount regardless of number of borrowers.

🧾 Tips to Reduce Your EMI Smartly

- ✅ Choose a shorter tenure (if you can manage the EMI)

- 💸 Make a bigger down payment or reduce loan amount

- 🔍 Compare SBI with other banks using this calculator

- 💳 Improve your credit score to get better interest rate

- 🔄 Try part-prepayments yearly to reduce interest burden

✍️ Final Words on Mortgage Loan Calculator SBI

Taking a mortgage loan is a long-term responsibility, often lasting a decade or more. Even a small mistake — like choosing the wrong tenure — can cost you lakhs of rupees in interest.

That’s why using this Mortgage Loan Calculator SBI before you apply is not just helpful — it’s essential.

Know your EMI. Adjust the plan. Compare the costs. Then apply — with clarity and confidence. ✅