📊 Mutual Fund Calculator – An Easy Way to Plan Your Investment

Hey there! So, have you ever wonder’d how people know exactly how much money they’ll get after investing in mutual funds? 🤔 Well… it’s not rocket science, they simply use a thing called Mutual Fund Calculator. And trust me, it’s a life saver!

In this blog, I’ll explain everything about mutual fund calculators in a simple way. So even if you’re not a finance person, no worries 😅

Let’s start…

👇 Try it now! 👇

📈 Mutual Fund Calculator

📊Result Preview📊

💡 What is a Mutual Fund?

Before we go deep into the calculator, let’s just quickly understand what mutual funds really are.

A mutual fund is basically a pool of money collected from different investors. That money is managed by professional fund managers, and it’s invested in stocks, bonds, or other securities. You don’t have to be an expert—just invest and let the professionals handle the rest. 🧑💼

Now, when you invest in mutual funds, you expect returns, right? That’s where the calculator comes in…

🧮 What is a Mutual Fund Calculator?

A Mutual Fund Calculator is a free online tool that helps you estimate how much return you can expect from your investment.

You just enter:

- Investment Amount (like ₹5,000/month)

- Duration (like 10 years)

- Expected Return Rate (like 12%)

And boom 💥 you get an approximate value of your final amount.

🧠 Why Should You Use It?

Good question! Many people invest blindly and then regret later. But a calculator helps you:

- 🔍 Plan Better: You can see what your money will look like in 5, 10 or even 20 years.

- 🎯 Set Realistic Goals: Want to buy a car or house? You’ll know exactly how much to invest monthly.

- 💸 Avoid Surprises: You won’t wake up one day and go “oh no, I didn’t invest enough!”

📈 Types of Mutual Fund Calculations

There are basically 2 types of mutual fund investments:

1. SIP (Systematic Investment Plan)

You invest a fixed amount every month, like ₹1,000 or ₹5,000.

This is great for salaried people.

Formula Used:

FV = P × [(1 + r)^n - 1] × (1 + r) / r

- P = amount invested per month

- r = rate of return / 12 / 100

- n = total number of months

But don’t worry, the calculator does this math for you 😉

2. Lump Sum Investment

You invest one big amount at once, like ₹1,00,000.

Formula Used:

FV = P × (1 + r)^n

Where:

- P = initial amount

- r = interest rate

- n = duration in years

Again, no need to remember formulas. Just use the calculator!

🤷 How Accurate Are These Calculators?

Here’s the thing… Mutual Fund Calculators are based on assumptions. They can’t guarantee exact returns because mutual fund returns depend on market performance.

But still, they give a very good estimate which is enough to make decisions.

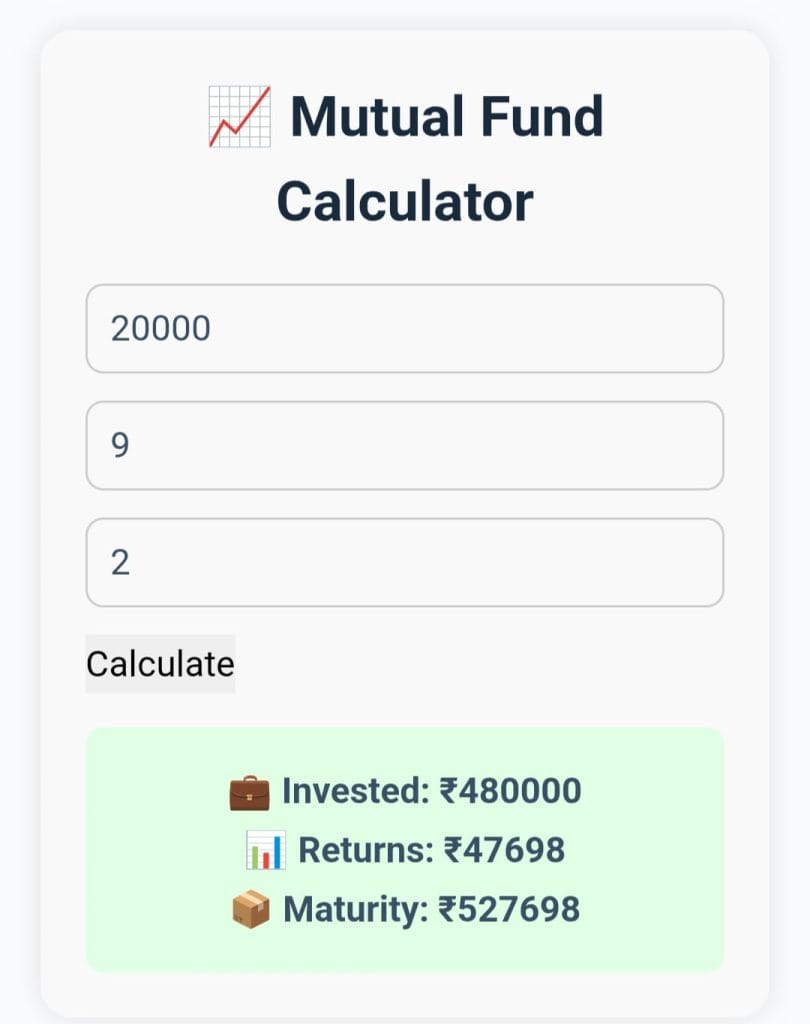

🔧 How to Use the Zenvita Mutual Fund Calculator?

Here’s how you can use our tool step-by-step:

- ✍️ Enter your investment amount (monthly SIP or lump sum)

- 🕒 Enter the time you’ll keep investing (in months or years)

- 📊 Enter the expected return rate (most mutual funds give around 10-15% yearly)

- ✅ Hit “Calculate”

Tada! You’ll see your maturity amount, invested total, and estimated profit 😍

💡 Tips Before You Use a Mutual Fund Calculator

- Be realistic with your return expectations. Don’t expect 20% always.

- Try different scenarios (5 years, 10 years, etc.)

- Check SIP vs. lump sum to see what suits you better

- Review your plan every 6-12 months

💥 Benefits of Using a Mutual Fund Calculator

✅ No manual calculation headaches

✅ Plan your retirement easily

✅ Helps you stay motivated with visual growth

✅ You can adjust your plan anytime

✅ Totally free & instant result

Honestly, once you use it, you’ll never go back to guesswork again. 🚀

🤔 Mutual Fund Calculator vs Other Tools

Many people get confused between mutual fund calculator, SIP calculator, and investment calculator.

Here’s a quick comparison:

| Tool | Purpose |

|---|---|

| Mutual Fund Calculator | General tool for all mutual fund types |

| SIP Calculator | Focused only on monthly SIP returns |

| Lump Sum Calculator | One-time investment growth estimate |

| Investment Growth Calculator | Can include other types of investment (not only mutual funds) |

If you’re into mutual funds, always use a dedicated Mutual Fund Calculator like ours at Zenvita Tools 🧠

⚠️ Common Mistakes to Avoid

❌ Setting unrealistic return expectations

❌ Not adjusting for inflation

❌ Ignoring expense ratio of the fund

❌ Thinking returns are guaranteed

❌ Forgetting to re-check after 1 year

Be smart. Always check, re-check, and plan accordingly.

📊 Real Example

Let’s say:

- SIP amount: ₹5,000

- Duration: 10 years

- Return: 12%

Then the Mutual Fund Calculator shows:

- Invested: ₹6,00,000

- Estimated Value: ₹11,61,695

- Total Profit: ₹5,61,695 🎉

Isn’t that amazing?

📝 Final Thoughts

In today’s fast-moving world, everyone wants their money to grow. And mutual funds are one of the best ways to do that. But without a clear plan, it’s like shooting in the dark.

The Mutual Fund Calculator is your flashlight 🔦

It guides you, helps you make smart choices, and gives peace of mind.

So go ahead, try our calculator today and take the first step towards smarter investments.