📘 SBI PPF Calculator – Know Your Future Savings Like a Pro

Planning for the future is not always easy, specially when it comes to money. Everyone tells you to save, but how much? And where? That’s where the SBI PPF Calculator comes in. It’s a simple tool, but honestly, it can be really powerful if you use it right.

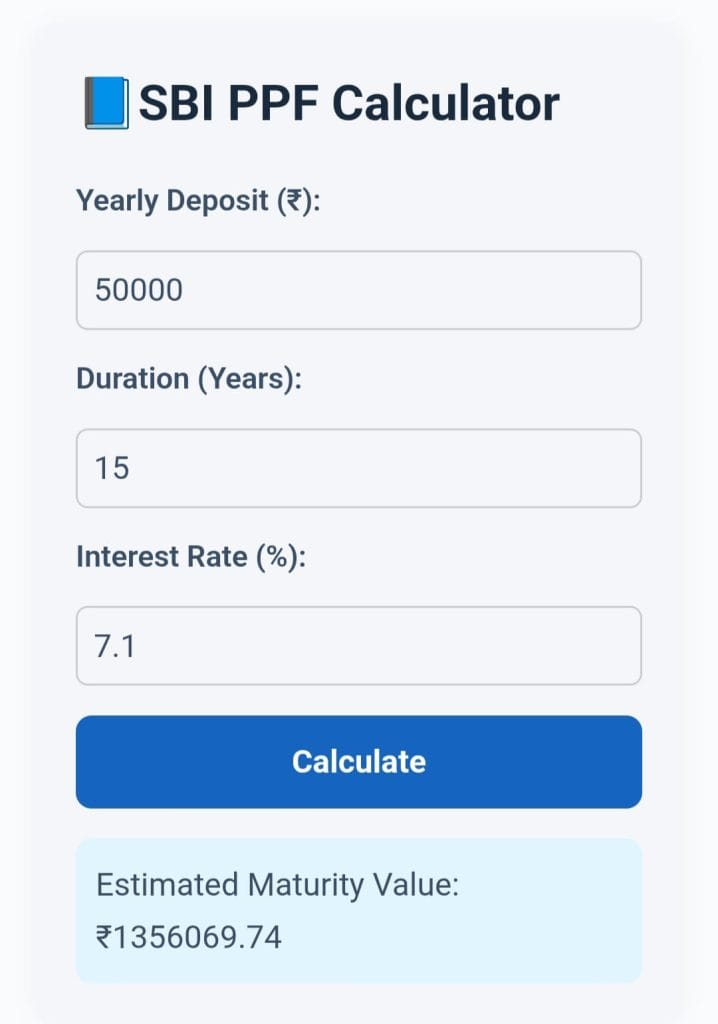

👇 Try it now! 👇

📘SBI PPF Calculator

📊Result Preview📊

🧐 What is SBI PPF?

PPF stands for Public Provident Fund. It’s a long-term savings scheme backed by the government. People love it because:

- It gives fixed interest (declared every quarter)

- It’s totally tax-free under Section 80C

- You can invest as low as ₹500 per year

SBI is one of the most popular banks where people open PPF accounts. Their process is simple, and online access is easy. But before you invest, you probably want to know how much you will get after 15 years. That’s where a calculator helps.

💡 Why You Need a PPF Calculator?

Let’s be honest, calculating compound interest manually is tough. And PPF is not simple interest — it’s yearly compounded, with some tricky rules. Like:

- You can deposit max ₹1.5 lakh/year

- You get interest on lowest balance between 5th and 30th of every month

- Interest is credited on 31st March every year

Without a calculator, you’re basically guessing. But with a SBI PPF Calculator, you can:

- See future value of your investment

- Plan how much to invest monthly/yearly

- Adjust the amount to get a target maturity value

- Compare if PPF is better than other options

🧮 How Does the SBI PPF Calculator Work?

It’s super simple. You just need to enter a few details:

- 💰 Your yearly or monthly investment amount

- 📅 Number of years (PPF matures in 15 years, but you can extend)

- 📈 Current interest rate (government decides every 3 months)

After that, the calculator shows:

- Total deposited amount

- Total interest earned

- Final maturity value

Most good calculators also give you a year-wise breakdown so you can see how your investment grows over time.

Example:

Suppose you invest ₹10,000 every year for 15 years at 7.1% interest.

You’ll deposit ₹1,50,000 in total. The calculator shows a maturity amount around ₹2.78 lakhs.

Pretty cool, right?

🎯 Benefits of Using Our SBI PPF Calculator

We made our calculator very easy-to-use. Here’s why it helps:

- ✅ No login or signup needed

- ✅ Mobile-friendly design

- ✅ Instant results — no waiting

- ✅ Shows everything in INR format

- ✅ You can change interest, amount, or duration anytime

And best part? It’s free forever.

🙋 Who Should Use the SBI PPF Calculator?

It’s useful for many people, like:

- Students who want to learn saving

- Salaried people who want safe tax-free growth

- Parents planning long-term goals for kids

- Anyone who wants to beat inflation safely

Basically, if you want to save money smartly, this tool helps you understand what’s possible.

😕 Common Questions People Ask

Q. Can I withdraw money before 15 years?

Yes, partially after 6 years. But full amount comes after 15 years.

Q. Is SBI PPF better than FD?

In many cases yes. Because it’s tax-free and gives compounding returns.

Q. Can I open two PPF accounts?

Nope. Only one PPF account is allowed per person.

Q. What if I miss a year?

Account becomes inactive. But you can reactivate it by paying a penalty + missed contributions.

🔐 Safe, Reliable, and Govt-Backed

The best thing about PPF? It’s not risky like stocks or mutual funds. Your money is 100% safe because it’s guaranteed by the Government of India.

That’s why most people open PPF accounts in trusted banks like SBI, Post Office, etc. But before you go to the bank, use the calculator to know what’s best for you.

📌 Final Thoughts

A lot of people ignore planning because they think it’s hard. But with small tools like this SBI PPF Calculator, you can plan your goals better, avoid stress later, and enjoy peace of mind. Whether you’re saving for a house, retirement, or your kid’s future — PPF is a safe option.

Don’t guess. Calculate. Compare. Decide smartly.