🚗 Vehicle EMI Calculator – Smart Way to Plan Your Vehicle Loan

Planning to buy a new bike or car? That’s awesome! 🚙🛵 But before signing those bank papers or getting excited by dealership offers, there’s one important question to ask: “How much EMI will I need to pay?” That’s where our Vehicle EMI Calculator comes in — helping you understand your monthly payments, total interest, and the best loan setup before you borrow.

👇 Try it now! 👇

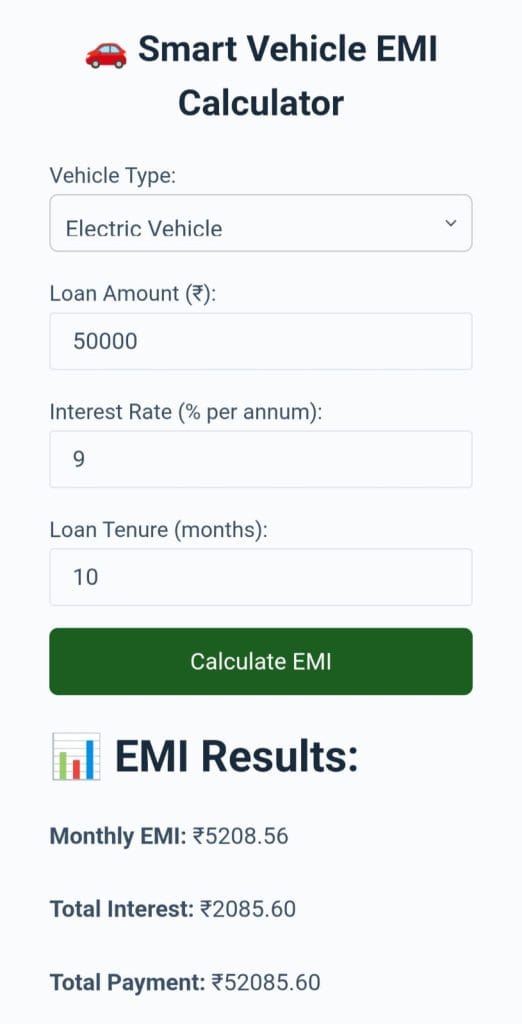

🚗 Smart Vehicle EMI Calculator

📊Result Preview📊

No confusion. Just a simple tool to plan smart.

🤔 What Is a Vehicle EMI?

An EMI (Equated Monthly Installment) is a fixed payment you make every month to repay your loan. It includes:

- The Principal amount (loaned amount)

- The Interest charged by the lender

Whether you’re buying a two-wheeler, four-wheeler, or even a used vehicle, your loan EMI depends on:

- Loan amount

- Interest rate

- Loan tenure

That’s why you must calculate EMI before applying for the loan — to avoid surprises later.

🧠 EMI Formula (Don’t Worry, We’ve Automated It)

The EMI is calculated using this formula:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Loan amount (Principal)

- R = Monthly interest rate (Annual Rate ÷ 12 ÷ 100)

- N = Loan tenure in months

Sounds complex? That’s why this calculator exists — it does all the math instantly.

🛠️ How to Use This Vehicle EMI Calculator

Super simple. Just enter:

- Loan Amount – How much you plan to borrow

- Loan Tenure – Duration of the loan (in months or years)

- Interest Rate – Typically 8% to 15% depending on vehicle and lender

💡 Hit “Calculate” and you’ll instantly get:

- Monthly EMI

- Total interest payable

- Total repayment amount

Change the values to compare options easily.

📊 Example Use Case

Say you’re buying a car with a ₹7,00,000 loan at 9.5% interest for 6 years:

👉 Our vehicle EMI calculator shows:

- EMI: ₹12,708

- Total Interest: ₹2,52,888

- Total Repayment: ₹9,52,888

That’s a ₹2.5 lakh extra over the loan period. See why planning matters?

🛵 Also Works for Two-Wheelers

Bike loans are common among students and new earners. Let’s take an example:

- Loan Amount: ₹85,000

- Tenure: 3 years

- Interest Rate: 12%

🧾 Your EMI = ₹2,825/month

You’ll pay about ₹16,000 extra as interest.

Whether it’s a bike, scooty, or electric vehicle — this tool helps you make the right financial decision.

📈 Benefits of Using Our Vehicle EMI Calculator

| Feature | Why It Matters |

|---|---|

| 🔍 Instant EMI Result | No manual math, get EMI in seconds |

| 📱 Mobile-Friendly | Works great on any phone or tablet |

| 💰 Transparent Cost View | Know full repayment cost (not just EMI) |

| 🔁 Try Unlimited Scenarios | Compare loan tenures, interest rates, and amounts |

| 🚀 Stress-Free Planning | Get peace of mind before you apply |

🏦 Typical Vehicle Loan Details (India)

| Loan Type | Loan Amount | Tenure | Interest Rate |

|---|---|---|---|

| Bike Loan | ₹20,000 – ₹2 lakh | 12 – 36 months | 9% – 24% |

| Car Loan (New) | ₹1 lakh – ₹50 lakh | Up to 7 years | 8% – 11% |

| Car Loan (Used) | ₹1 lakh – ₹20 lakh | Up to 5 years | 11% – 16% |

| Commercial Vehicle | Varies widely | 1 – 7 years | 10% – 18% |

These vary by bank, lender, and credit score. Our calculator works with any rate.

📉 Tips to Reduce Your EMI

- 💳 Maintain a good credit score (>750)

- 💸 Make a bigger down payment upfront

- 📅 Choose a longer tenure (but be careful — more interest overall)

- 📋 Compare multiple bank offers before applying

- 🧾 Avoid extra add-ons at dealership that inflate loan

❌ Mistakes to Avoid

| Mistake | Why It’s Costly |

|---|---|

| Borrowing 100% of on-road price | Higher EMI & interest burden |

| Ignoring processing/prepayment fees | Actual cost may rise unexpectedly |

| Focusing only on EMI, not tenure | Lower EMI ≠ cheaper loan |

| Skipping pre-calculation | May regret later when EMIs hurt budget |

💬 FAQs

Q: Can I use this calculator for bikes and cars both?

Yes! This is a universal vehicle EMI calculator for any type of auto loan.

Q: Are the results accurate?

Yes — based on standard bank EMI formulas. It gives a very close estimate.

Q: Does using this calculator affect my credit score?

Nope. It’s completely private, free to use, and doesn’t need any personal details.

Q: Can I check multiple scenarios?

Yes. Try as many combinations as you want — different interest rates, amounts, and tenures.

✍️ Final Words on Vehicle EMI Calculator

Buying a vehicle is more than just choosing a color or brand — it’s a financial commitment for years. One small mistake in planning your EMI can create stress month after month.

That’s why tools like this Vehicle EMI Calculator are so helpful. It gives you a complete, realistic picture of what your monthly outgo will look like. So you can decide confidently — not blindly.

Try it now, plan smart, and drive stress-free. 🚙📊💸